Now that the #TrumpTariffs are in place, we know that utility-scale solar will take a hit. GTM Research is expecting an 11 percent decrease in U.S. solar PV installations over the next five years — 7.6 GW reduction from pre-tariff expectations, 65 percent of which is in utility-scale.

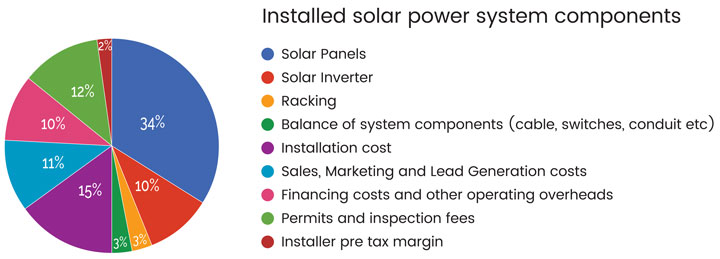

But optimism remains in the residential market. Let’s start with just how much the tariff will increase the price of a residential solar installation. Based on the cost breakdown by component provided via SolarReviews (Fig 1. below), a 30 percent tariff would add $0.21 per watt or 6.8 percent to the retail cost of a solar system. But as Andrew Sendy, chairman of Solar Investments Inc., points out, this isn’t quite true. His analysis via Solar Estimate:

“The 70 cents average wholesale cost of solar panels in the United States is a blend of the cost of premium panels which can be around 90 cents per watt at the wholesale level [i.e Sunpower, Panasonic and LG] and the widely used Tier One Chinese solar panels such as Canadian Solar, Trina, ReneSola and Jinko, which have been sold during 2017 in larger volumes at the wholesale level for around 50 cents per watt,” Sendy writes. “If we look at the effect the new tariffs have on the cost of Tier One Chinese modules, selling for $0.50 per watt in 2017, then all things being equal the 30 percent tariff would add 15 cents per watt to the wholesale cost of panels themselves. This would equate to around 4.9 percent of the retail price of a solar system based on SolarReviews research.”

A 4.9 percent increase would increase the average residential cost of solar to $3.23 per watt and the cost of an average sized solar system of 6-kW by $900 to $19,380 before the solar tax credit or $13,566 after the tax credit.

Obviously this is some back-of-the-napkin calculating, but a useful exercise to show how minimal that bump in price could be for a residential system after factoring in:

- The impact of more widely available financing mechanisms that provide more financial flexibility and payment terms (much more on this on page 24).

- The further reduction of solar company margins and installation labor costs.

“With the solar tax credit in place nationally and net metering laws in place in around 30 states, many Americans simply do not know how good an investment installing solar panels on their home is,” Sendy continues. “As we come towards the end of the 30 percent solar tax credit in December 2019, I predict consumers will rush to get solar installed while this incentive and net metering are available. This will mean that solar companies will be able to spread the recovery of their fixed costs over more jobs. That means the fixed costs per job and per watt will fall.”

Conclusion (educated guess)

Overall, Sendy and Solar Estimate’s best guess is that the average falls in retail solar costs seen in recent years will be replaced by stable solar prices in 2018. His rationale:

- The immediate impact of a 30 percent tariff will be reduced because of the large volumes of stock already shipped into the United States prior to the announcement of this tariff. In some cases, there is enough stock to meet almost six months of demand.

- There undoubtedly will be rises in the wholesale price of modules, but these will be less than 30 percent as Chinese companies continue to lower costs.

- What increases there are in cell prices and module prices at the wholesale level will be offset by increasing volumes for residential installers (ahead of the reduction in the solar tax credit at the end of 2019) that will lower the amount of fixed costs per job and per watt sold.

- This lowering of fixed costs per job, solar company margins per job and installation costs through the greater use of internal electricians and roof laborers will at least compensate for the increase in wholesale module prices, meaning that despite the new tariffs, the retail cost of installed residential solar power systems will remain flat in 2018 at $3.08 per watt. This equates to $18,480 for an average-sized 6 kW system before the 30 percent solar tax credit, and $12,396 after the tax credit is claimed.

This will be the first year that solar panel installation costs haven’t fallen in the last decade, and it is a remarkable feat by the industry to be in a spot where it can adapt and possibly absorb such a big hit.

— Solar Builder magazine

Leave a Reply

You must be logged in to post a comment.