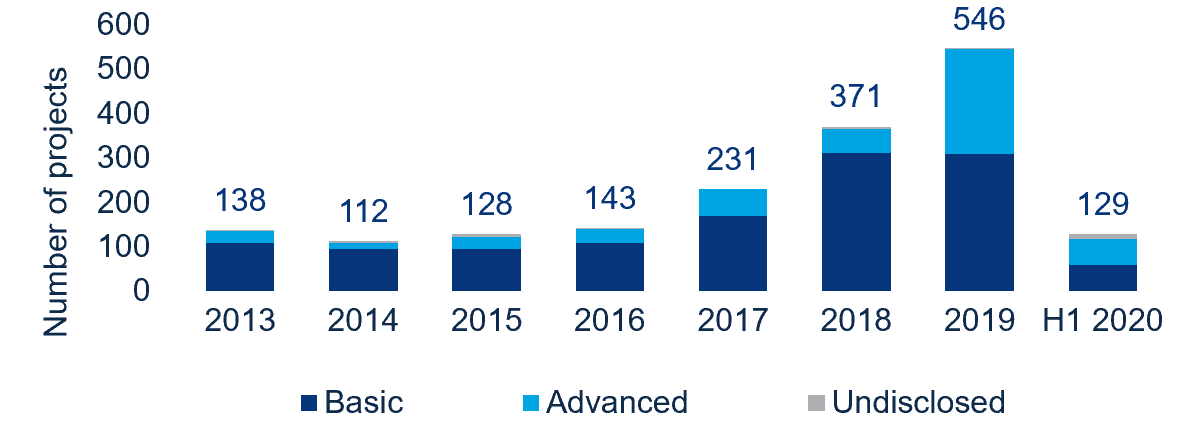

Five hundred and forty-six microgrids were installed in the United States during 2019, more than any previous year, according to new research from Wood Mackenzie. Three organizations – PowerSecure, Enchanted Rock and The American Red Cross – installed a combined 67% of these projects.

While 2019 saw a record number of microgrids systems installed, annual capacity was down 7% from 2018.

“Most of the systems installed last year were below 5 MW. This is part of a larger trend we are seeing. The market has shifted from being led by projects above 5 MW pre-2017 to smaller systems starting in 2017. Technology-neutral microgrid developers are taking notice and developing more modular designs,” said Isaac Maze-Rothstein, Wood Mackenzie Research Analyst and report author.

Though the systems installed by PowerSecure and Enchanted Rock were almost all basic, Red Cross’ systems rely on Blue Planet Energy’s energy storage solution. These are some of the first mass deployments of solar-plus-storage at non-residential locations that are designed to power schools for more than 24 hours.

Distributed fossil fuel generation accounted for 86% of installed microgrid capacity in 2019, according to the Wood Mackenzie report.

“Although most of the power distributed via microgrids came from fossil fuel generation last year, we believe that microgrids in the US will become increasingly reliant on renewables technologies. Through our five-year forecast we are optimistic that solar, wind, hydropower and energy storage will grow to account for 35% of annually installed capacity by 2025,” added Maze-Rothstein.

Despite 2019 capacity beating Wood Mackenzie’s forecast expectations, the outlook through 2025 is more conservative due to coronavirus impacts.

The first half of 2020 was the slowest start to the year for the microgrid market since 2016.

Shelter-in-place orders and social distancing have already delayed permitting, engineering, construction and interconnection processes for developing microgrids. “While these challenges are being felt now, some developers have expressed concerns around originating new deals as some customers wait to see how the pandemic and recession impact their core business.

“Our outlook for the next two years has been decreased primarily due to project delays.

“Starting in the second half of 2022, we expect to see the challenges of originating new deals during 2020 impacting capacity additions through 2024,” said Maze-Rothstein.

— Solar Builder magazine

Leave a Reply

You must be logged in to post a comment.