Solar module procurement has been precarious the last few years. The Section 201 tariffs of the Trump Administration. The Auxin petition to expand the bounds of the anti-dumping and countervailing duty (AD/CVD) tariffs. The allegations of forced labor in China’s Xinjiang province and the resulting Withhold Release Order (WRO) and Uyghur Forced Labor Prevention Act (UFLPA) sanctions on imports with components tied to that region.

Will the “normal” market return? Maybe. If it does, is that even a good thing? This disruption has been a great time for the U.S. solar industry to look in the mirror, and it has given solar businesses a chance to proactively pursue a new normal — one that’s more scalable and involves less risk and less inherent complexity for buyers.

In “Pro Cures,” in the Q1 edition of Solar Builder magazine, we looked at three different module procurement platforms that add some level of transparency, analysis or buying power that would be difficult for any one company to achieve on its own. Here is an excerpt from that feature. Check out the full “Pro Cures” article in the Q1 2023 edition of Solar Builder:

Solar Builder Instant Access

Get instant access to the digital edition of Solar Builder magazine.

The EPC expertise of Anza

Anza is the online procurement platform built by Borrego (previously one of the largest distributed generation EPCs and developers in the U.S.) to empower all other EPCs, developers and independent power producers (IPPs) with a module procurement solution that not only offers preferred pricing from many vendors but also Borrego’s time-tested engineering expertise.

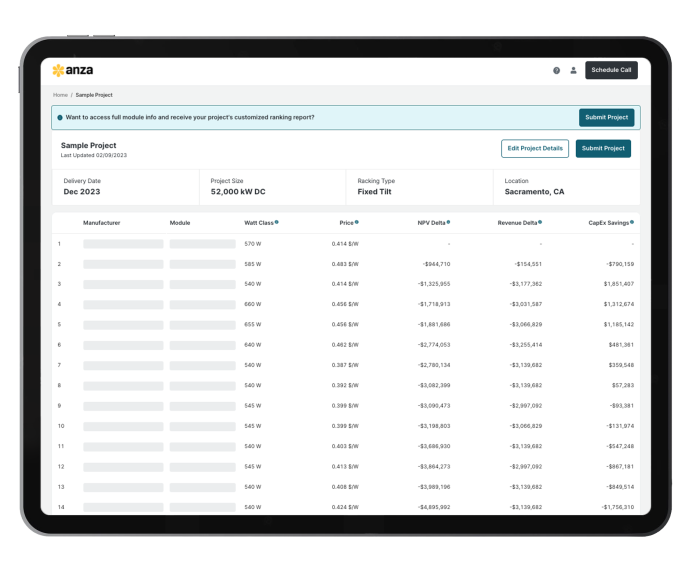

Borrego is focused on making Anza the place for solar module and energy storage procurement (and eventually other equipment). Instead of being Amazon, Anza’s tech analogy is Kayak or Expedia, where equipment buyers can search and compare equipment options online after providing a few specific project details. From there, Anza gets to work calculating a ranked list of 20 to 40 modules that best fit that project.

This ranking (generated within seconds) is displayed in a sortable table that includes specs like Wattage, price per Watt, etc. — including a calculation of net present value (NPV). Anza also includes PAN file analysis for every module and has answers regarding wafer and polysilicon suppliers and third-party audits.

“Most buyers know how to figure out what module is best for their project or portfolio, but most don’t have the time or the internal engineers or estimating capabilities to do so,” says Aaron Hall, president of Anza. “They have a general financing model that works well, but what goes into that? This is the stuff we have done for years as part of our development projects and EPC estimating. You need to understand the BOS cost impact of your module selection decision. How will it affect labor, dc electrical and string sizes? Efficiency impacts things like module form factor and CapEx components. All of these things have real impacts.”

Anza does all of this calculating instantaneously, based on Borrego’s experience, for all of the modules in its database. Product availability and pricing info is updated every day. Buyers can track their recommended modules for a specific project over time until they see the NPV they want or are ready to purchase. Soon, customers will be able to add even more project-specific parameters in Anza, like PPA price, labor rates, etc., to better dial in the assumptions.

For distributed generation IPPs, developers and EPCs, the system has obvious value.

“Half of the module companies you would call, you might not be active with. In those cases, the price you’re quoted is likely not their best price,” Hall says. “And even if you are ready to purchase immediately, you need to get a contract negotiated. That process could take weeks or months. And by then, that analysis is no longer valid because availability changes and maybe new options have come to market.”

For utility-scale module buyers, Anza can help speed up the module purchasing process, even for customers capable of doing it on their own. Every cent counts in utility-scale purchasing, but so does every second, and saving cents per Watt takes a ton of time. Calling multiple module companies or running RFPs, staying up to date on their pricing and availability, running their specs through engineering, following back up, negotiating a contract — all of it potentially wastes time and opportunities.

“Time is not on your side when you’re buying. If we can save that time, we think that presents a lot of value,” Hall continues. “The largest buyers in the world don’t need pricing help, but they have the same problems to solve. Not all utility-scale buyers have internal staff to run all the analysis needed, or they’re bandwidth constrained and depend on outside consultants to round out their staff.”

During our chat, Hall was able to show me hundreds of hours of utility-scale project procurement work done in about 10 minutes using the app.

“Even if they don’t believe our calculations, we’re at least making the pool of options very small,” Hall says. “We’re taking 40 module options and saying let’s concentrate on these top three, and then do all you’d normally do if you don’t believe us. Spend three weeks doing the work and come back and place the order.”

Solar Builder Instant Access

Get instant access to the digital edition of Solar Builder magazine.

tart one.”

— Solar Builder magazine

Leave a Reply

You must be logged in to post a comment.