High power wattage is the name of the game in the solar marketplace now, due to the combination of large-format panels and n-type technology. Independent energy research agency TrendForce estimates that large-format wafers, cells and modules will account for more than 90% of the total production capacity in 2023, and demand for large-format products will demonstrate strong growth.

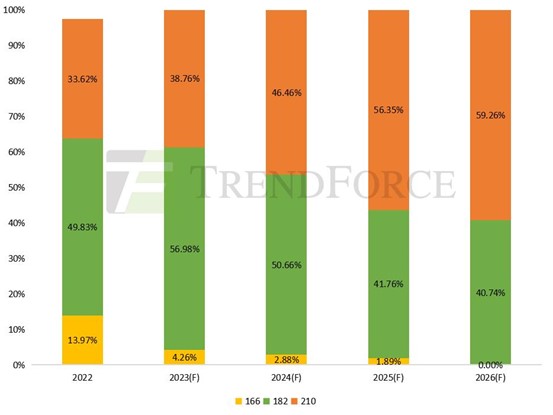

The power of 182 mm n-type modules increases from 500W+ to 600W+, while the power of 210mm n-type modules exceeds 700W — and 210 mm modules will account for nearly 60% of total production capacity.

Figure: Market share of modules (Unit: %)

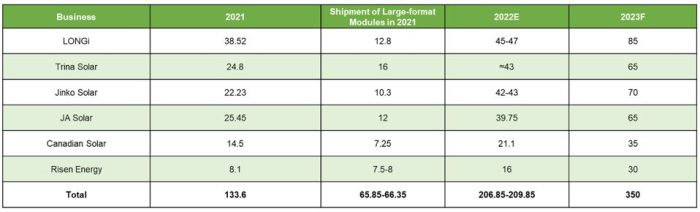

Suppliers | The top six module manufacturers’ shipments in 2022 were around 205-211 GW, accounting for 76-78% of the annual module demand of 270 GW. Among them, LONGi, Trina Solar, and JinkoSolar all shipped more than 40GW.

In 2022, shipments of large-format modules grew faster, accounting for more than 80% of total shipments. As of the first quarter of 2023, the cumulative shipments of 210mm modules had exceeded 120GW. Shipments of large-format modules will continue to rise as market demand and production capacity expand.

Wafers | TrendForce expects a faster increase in demand for large-format wafers in 2023, with its market share increasing rapidly from 83.45% in 2022 to 95.74%. In 2023, the production capacity for large-format wafers will hit 792.4GW, showing a stronger tendency toward larger formats, while 210mm wafer production capacity will hit 320.8GW, increasing by 74.6%, with a market share of 38.76%.

Figure: Capacity ratio for wafers of different sizes between 2022 and 2026 (Unit: %)

Cells | the capacity for large-format cells will reach 822.3GW in 2023, accounting for 94.99% of total capacity. 210mm cell capacity will reach 587.75GW, an increase of 83.7% from 2022, with a market share of 67.9%.

Modules | TrendForce anticipates a significant increase in production capacity for large-format modules in 2023, reaching 767 GW with a market share of around 90%. Among them, 210mm module capacity will reach 508 GW, a 68.14% increase from 2022, with a market share of 59.62%, indicating continued strong growth.

Bidding | In terms of bidding trends, projects clearly favor large-format modules. According to TrendForce, high-power modules are in demand among the nearly 129GW centralized procurement of PV modules announced by COEs and SOEs in 2022, with large-format modules dominating. Over 115GW of the bidding projects specifically require 182/210mm modules, accounting for 89.21% and indicating an increasing demand for large-format modules, a key component of the industry chain for reducing costs and increasing efficiency.

— Solar Builder magazine

Leave a Reply

You must be logged in to post a comment.