After 10 steadily successful years of the U.S. solar industry, what have we learned?

It’s often difficult to comprehend how far the solar industry has come in the last 10 years. But just look at the numbers: In 2004, the United States had 155 MW of installed solar capacity — total. Only 2 MW of utility-scale solar came online that year. At the beginning of 2014, the U.S. industry was sitting on more than 12 GW total. And 4,751 MW of that came in 2013 alone — 2,847 MW from utility-scale installations (all data from GTM Research and SEIA).

A lot has changed since 2004. Just as Apple, Google and Facebook have transformed the way we communicate and interact in the last decade, solar companies have completely flipped the industry upside down with new technologies and better-designed products, and solar is now as attractive to customers as ever.

Solar Builder talked with three solar companies that got their start in 2004 — mounting manufacturer SunLink, microinverter manufacturer SolarBridge Technologies and developer Standard Solar. How have they improved their businesses as they’ve ridden the steep incline of the solar roller coaster? Do they expect a sudden drop any time soon, or is there room to keep climbing? We’ve had fun listening to stories of the past and peeking into the crystal ball to see what we’ll be talking about in 2024.

Mounting System Manufacturer

SunLink — San Rafael, California

When SunLink started producing mounting systems 10 years ago, founder John Eastwood says the field was wide open. A few companies were out there — Power Light (eventually purchased by SunPower) and Unirac had been around for a handful of years — but no one was really dominating the mounting market.

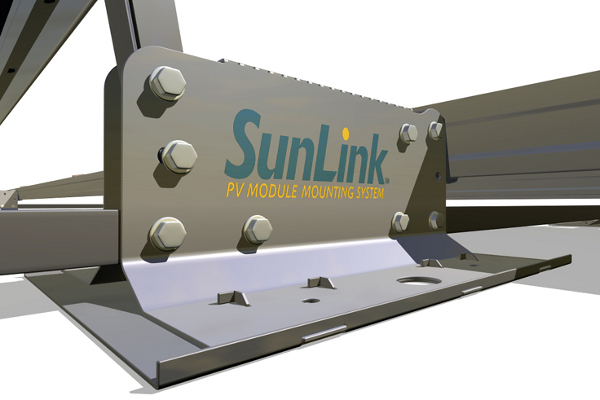

One of the first renderings for the company’s RMS legacy system.

“In 2004, there were few competitors in the mounting system space,” Eastwood says. “To start a solar racking company today would be considerably more challenging. The level of support expected by the larger, more sophisticated integrators, EPCs, developers and owners in today’s market is much higher than it was 10 years ago. Cost pressures have also continued to mount. These factors have combined to create the most challenging market we’ve seen. At the same time, they’ve inspired a wave of industry consolidation driven by the need to attain the volume necessary to deliver on service and price. It is going to get increasingly difficult to start a new racking company.”

CEO Chris Tilley says every stakeholder in the industry — manufacturers, customers, engineers, permitting officials — has become more sophisticated in the last decade.

“When SunLink was founded, we were one of a handful of pioneers in a marketplace that could have very easily been compared to the ‘Wild West’,” he says. “There were few industry standards in terms of design or performance requirements, and companies were designing and installing very inconsistently. Today the solar sector has matured considerably on both the structural and electrical sides of the equation, which has generally made systems safer.”

As the industry began to work out the kinks and manufacturers produced safer, more reliable and cheaper products, solar really took off in America.

“The industry has progressed much further and faster than we would have ever considered possible in 2004,” Eastwood says. “The availability of low-cost Chinese modules has been an enormous driver in this regard. In 2004 modules were approximately $4 per watt. Now they are approximately $0.75 per watt and dropping. This has been an unanticipated turn of events and a significant factor in the exponential growth of the solar industry. The fact that large fixed-tilt systems are being installed for a total cost of just over $1 per watt is remarkable and bodes well for the future of solar.”

SunLink founder John Eastwood talks to customers at a 2004 ASES show, which he recalls was held in a “hotel garage in Portland.”

Eastwood believes mounting system prices will continue to drop, but at a much slower pace than what has been experienced in recent years. Safety will again become a stronger focus in the coming years.

“We predict [that] the need to satisfy the insurance industry regarding fire safety and other standards through UL certification is going to significantly impact rooftop mounting systems,” Eastwood says. “In fact, we believe compliance with evolving standards is poised to be a game changer in the rooftop sector of the market, particularly negatively impacting non-metallic systems that are more prone to damage from fire.”

SunLink overall expects the global solar industry to see exponential growth in the next 10 years. With the company’s decade of experience, Tilley says SunLink is in good shape for what’s to come.

“SunLink’s tagline is ‘install confidence,’ and that is exactly what our longevity promises our customers,” he says. “Longevity equals experience, and we have learned a great deal from our experience which provides comfort to our customers and puts us in a much better position to serve them than those manufacturers without our proven track record.”

ACPV/Microinverter Manufacturer

SolarBridge Technologies — Austin, Texas

SolarBridge got its start with power electronics technology in 2004 and really ramped up its solar development in 2007. Initially, the company considered focusing on string inverters but soon realized there was a real need for reliability and distributed power. Today, SolarBridge has taken the microinverter and really transformed the way people think about DC and AC power.

“In those days, nobody was using microinverters or AC modules. We were almost laughed out of the room in some meetings,” says Pat Chapman, co-founder, CTO and vice president of advanced development. “Now microinverters account for almost 50 percent of the residential market, and every company has to have a module-level power electronics strategy. We’ve been involved in just about every module company’s discussion of that strategy, because of our focus on reliability. What we have learned is to stay the course, to never compromise on reliability and to build a strong ecosystem of partners who can build a market with you.”

Three of SolarBridge’s original founders — (L-R) Phil Krein, Brian Kuhn and Pat Chapman — at a recent 10-year anniversary party.

Chapman says he agrees with those at SunLink — it’s much more difficult to start a solar manufacturing company today than it was 10 years ago.

“The market to raise money is much tougher,” he says. “If you’re not in cloud computing, or big data, or you’re not on Twitter or Instagram, it’s tough. Clean tech was a big trend then. New startups coming in now have an uphill battle. It’s harder for hardware and module technologies to get funded because now we’re in a cost reduction phase of the market. There’s still tons of innovation to come — integrating with energy storage, module integration, taking margin out of the integration itself. There is so much innovation yet to come.”

Energy storage and smart grid innovations will be the next big things in the industry, Chapman says. These advances will continue to make solar an attractive choice for customers.

“We’ve grown up quite a bit. There are a lot more choices for solar consumers now, and the choices are good,” Chapman says. “We’ve grown from systems that were very expensive with suspect payback times, to systems that meet grid parity with finite payback times that you can finance in a lot of ways. Now, the importance of having site-level monitoring is way up, and module-level monitoring is often considered a must-have feature of solar. For years, system owners may have had underperforming or nonperforming systems. Now people have insight into whether they’re getting the value out of solar. It’s hard to think of something going on in solar that’s more exciting than this.”

Chapman says the advances in installation times has transformed the industry and gained customer acceptance.

“Solar used to be an engineering science project; now it’s like installing a new water heater,” Chapman says. “It used to take two or three days to install a system; now you can do two or three in a day. There were all these barriers before — financial, technical, etc. Now those barriers have been removed.”

Building a name and having 10 years of practice with electronics and solar technologies really benefits SolarBridge when it comes to establishing new customers, Chapman says.

“Longevity is important to the business, especially in customer service,” he says. “There’s brand loyalty in that — the market has learned that the lowest price module isn’t always the best investment. Absent anything else, people will go with the more trusted, well-known brand that has withstood the test of time.”

Developer/Installer

Standard Solar — Rockville, Maryland

In 2004, there weren’t a lot of incentives for people to purchase solar systems. Standard Solar started as a residential installation company, building systems for those wanting to make an environmental statement. It wasn’t until 2008 when incentives — like the 30% investment tax credit (ITC) — started spilling into Maryland that Standard Solar looked at commercial options.

Standard Solar’s first commercial installation at the Department of Energy in Washington, D.C., in July 2008.

“Until 2008, we were a residential solar installer, primarily doing business in D.C., Maryland and Virginia,” says CEO Tony Clifford. “We got our first commercial job when Sunpower (then our module supplier) asked us to install a 205-kW system on the roof of the Department of Energy headquarters in downtown Washington. That install really put Standard Solar on the map. When we completed it in August 2008, it was the largest solar installation between New Jersey and central Florida. And that was only six years ago. It may not even be in the Top 10 in Washington, D.C., now. There’s been a real sea change in this area.”

Power purchase agreements (PPAs) and appropriate finance options have really sped along the installation game. Clifford says it’s easier for new installation companies to get started, but it’s more difficult to grow into a successful company.

“Anyone can get a residential solar business started, but dabblers also tend to get weeded out,” he says. “Getting a residential solar business past two guys and a truck is a challenging process. We’ve been through the growing pains. We’ve built a solid business over the past 10 years. There are plenty of opportunities for newcomers, but they have to do the work to get to the point that we’ve managed to get to.”

Clifford says the real growth opportunity is in residential solar going forward. Q1 2014 saw 480,000 solar systems installed in the United States, with the vast majority being residential systems. Clifford says while that is great progress, the market potential of residential solar has barely been tapped.

Standard Solar’s first truck in 2006.

“Residential solar systems cost about the same as many automobiles,” he says. “You’re going to see local banks, credit unions and other financing organizations get into the business of financing solar systems. I think as more attractive loan options show up for residential systems, there’s going to be a shift away from leases and PPAs to more homeowner-financed systems, and I think that’s great for local solar installers. There’s a real opportunity there.”

Installers may have to deal with fewer manufacturing companies in the future, Clifford suggests. He says more mature industries, like automobiles or semiconductors, typically have 10 companies doing 75-80% of the worldwide business in their industries. Today in PV, Yingli is the world’s largest module manufacturer, and its share in 2013 was only 10%.

“There’s no way that PV manufacturing is a mature industry yet,” Clifford says. “We’ll see some real shakes there. I don’t know who will end up being the survivors in this, but we’re probably going to end up with 10 to 12 huge solar manufacturers that all address the worldwide market.”

The next hurdle will be when the ITC expires in 2016, Clifford says. That, coupled with the recent trade war with China, could halt the steady growth pattern of the solar industry.

“We’ve been on this multi-year fight and effort to reduce costs across the board,” he says. “The only thing that has slowed that has been in cases with China. We have seen module prices go up, not down. If we don’t hit utility cost-competitiveness by the time the investment tax credit goes away in 2016, then the industry will be in trouble for a while.”

In 2008, Standard Solar signs its first PPA with Kelly Electric in Washington, D.C., for a 150-kW rooftop system (CEO Tony Clifford is second from right).

[source: http://solarbuildermag.com/featured/decade-sunlink-solarbridge-standard-solar/]

Leave a Reply

You must be logged in to post a comment.