The number of Asian companies appearing among the world’s 10 largest PV inverter suppliers doubled in 2013, with four from China and Japan appearing within the charmed circle, compared to just two in 2012 and none in 2011, according to new analysis from IHS Technology.

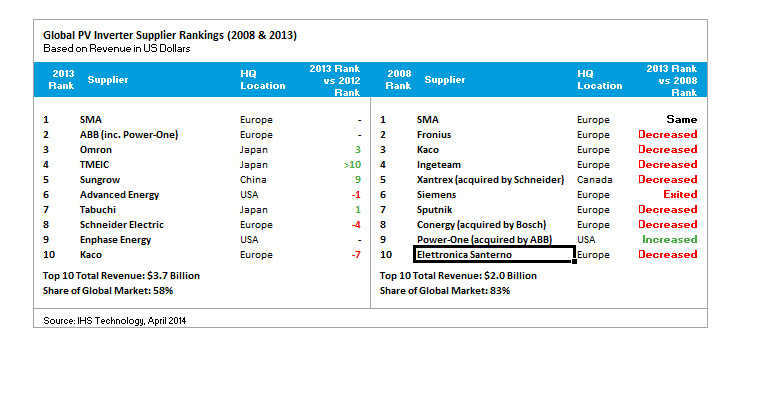

Rising demand for PV inverters from Asian markets has resulted in domestic suppliers accounting for a growing share of the global market. China and Japan together represented 35 percent of global PV inverter revenue in 2013, unlike just 12 percent in 2011. Capitalizing on the high-entry barriers to international suppliers in these booming regions, Asian suppliers have succeeded in dominating their domestic markets and have now been catapulted into the global top 10, as shown in the attached table.

Rising demand for PV inverters from Asian markets has resulted in domestic suppliers accounting for a growing share of the global market. China and Japan together represented 35 percent of global PV inverter revenue in 2013, unlike just 12 percent in 2011. Capitalizing on the high-entry barriers to international suppliers in these booming regions, Asian suppliers have succeeded in dominating their domestic markets and have now been catapulted into the global top 10, as shown in the attached table.

These findings can be found in the report, “PV Inverter World Market Report – 2014,” from the Power & Energy service of IHS.

Chinese-based inverter manufacturer Sungrow continued to command a leading position in the fast-growing Chinese market. In last year’s final quarter alone, the company shipped over 2 GW of inverters, the majority to its domestic market. China underwent an intense rush to complete photovoltaic systems before the end of 2013 in order to beat a scheduled decrease in the feed-in tariff rate.

Sungrow’s shipments nearly equaled a record held by Germany’s SMA Solar Technology, which achieved almost 2.4 GW of global shipments during a single quarter in 2010. But even though Sungrow shipped more inverters in megawatt terms in the final quarter of 2013 than any other supplier, extremely low average prices for central inverters in China meant that it was only the second largest supplier in revenue. Even so, this marked a notable increase considering that Sungrow had not appeared in the top 10 during any other single quarter in 2013.

Japanese suppliers Omron, TMEIC and Tabuchi also appeared in the top10 for 2013. PV installations in Japan last year are estimated to have grown nearly threefold, making up 17 percent of global demand. As the three largest PV inverter suppliers in Japan, Omron, TMEIC and Tabuchi are also the third, fourth and seventh largest suppliers in the world, respectively.

“The rate at which the solar landscape has transformed has been incredible, and it has initiated a major shift in the competitive environment for PV inverter suppliers,” said Sam Wilkinson, solar research manager at IHS. “As growth from China and Japan continues to outpace the global market in 2014, both Chinese and Japanese suppliers are likely to further improve their positions in 2014.”

East heads West

While the domestic business of these four Asian suppliers has enabled them to achieve significant share in global market revenues, all have minimal sales outside of their home markets.

“Although Asian suppliers have had a huge impact on the global rankings due to their success in local markets, their bearing on international markets outside of China and Japan has currently been quite limited,” noted Wilkinson. “Just the same, the economies of scale, expertise and brand strength that they have now been able to achieve makes them well placed for international expansion, and the world is likely to see many of these suppliers play a greater role in markets outside Asia over the next two to three years.”

Western suppliers lose ground

In contrast to the success of Asian suppliers, the competitive position of Western firms has worsened considerably. In 2008 eight of the top 10 spots were held by Europeans—and the remaining two also had strong European connections; but only four remained in that echelon as of last year. IHS also noted that three of the largest manufacturers in 2008 have also been acquired, while one has exited the industry altogether.

“The decline of the PV market in Europe has placed European suppliers in a very vulnerable position,” Wilkinson said. “Many of these suppliers relied heavily on Europe as the backbone of their business and were highly exposed to the rapid shift in demand from Europe to other regions. Annual PV inverter revenues from Europe have halved in the last two years, creating an extremely tough competitive environment, and many of the leading names from five years ago have vanished from today’s list of leading suppliers.”

Power-One from California, which was acquired by Swiss industrial electronics giant ABB, is the only supplier in the top 10 five years ago that has improved its rank.

“Power-One remained the second largest supplier in 2013, a position which it has now held for four consecutive years, and further closed the gap between itself and the market leader, SMA,” Wilkinson added. “Power-One was incredibly successful in capitalizing on the boom in the Italian market in 2010, expanding into new regions and creating a strong brand in the solar industry. Its acquisition by ABB now also gives it significant financial strength, vast existing international operations and a highly bankable brand name, which will place it well for future success.”

— Solar Builder magazine

[source: http://solarbuildermag.com/news/asian-companies-lead-global-solar-inverter-rankings/]

Leave a Reply

You must be logged in to post a comment.