This final article in our Countdown to 2020 series originally appeared in the November/December 2019 issue of Solar Builder. Subscribe here for free if you haven’t already.

The launch of California’s Title 24 new build solar mandate is less than two months away, and it’s nowhere near the top energy story in the state. California is grappling with how to ensure reliable, resilient power for all residents amid wildfires, Public Safety Power Shutoffs and utility bankruptcies while also trying to hit aggressive carbon reduction goals. California needs new solutions deployed, and it needs them fast.

It has me thinking about a question Lynn Jurich, CEO of Sunrun, posed as the keynote speaker at Intersolar North America 2016: Who can build a gigawatt faster? She pointed out that one 1,000-MW combined cycle gas plant takes about four years to come together, from identifying and acquiring the site to getting it up and running. Meanwhile, 142,857 distributed 7-kW solar arrays could be brought online within just four months.

That was nearly four years ago, and her case has only improved since. An economic analysis done by Station A in partnership with Sunrun and Stem shows that at today’s costs, solar and batteries on homes and businesses in California have the potential for 48 GW of rooftop solar and 42 GWh of battery storage, which would provide 9 GW of resource adequacy capacity across California. This is the equivalent of 20 large natural gas power plants or four times the size of the Diablo Canyon nuclear power plant slated to retire in 2025. Point being, at this moment in history, it may be more efficient and effective to think small and distributed.

With that as the backdrop, this final part of our Countdown to 2020 series will focus on the new models and technology emerging right along with California’s solar mandate to not just build new solar homes but to form the foundation of a more modern, resilient, flexible, sustainable energy framework.

Before you head into installment V of our Countdown to 2020, here are the previous four installments if you need to catch up:

Installment I: The role solar plays in California’s new building efficiency standards

Installment II: Constructing a new solar pathway

Installment III: Would you like solar with that?

Installment IV: How California is both boosting and undermining its solar + storage future

Installment V: Can the solar sector and grid planners meet in the middle?

Virtual rationality

East Bay Community Energy (EBCE) made headlines with its Oakland Clean Energy Initiative this summer. EBCE is pairing a front-of-the-meter 20-MW battery with a landmark 10-year virtual power plant (VPP) contract with Sunrun to bundle 500-kW of storage from its solar + storage residential customers. EBCE directly tied the battery to the retirement of the jet-fuel burning Oakland Power Plant, while the VPP bolsters capacity. Replacing a polluting power plant in Oakland with solar and batteries shows how California can find a path to a more reliable grid with localized clean energy.

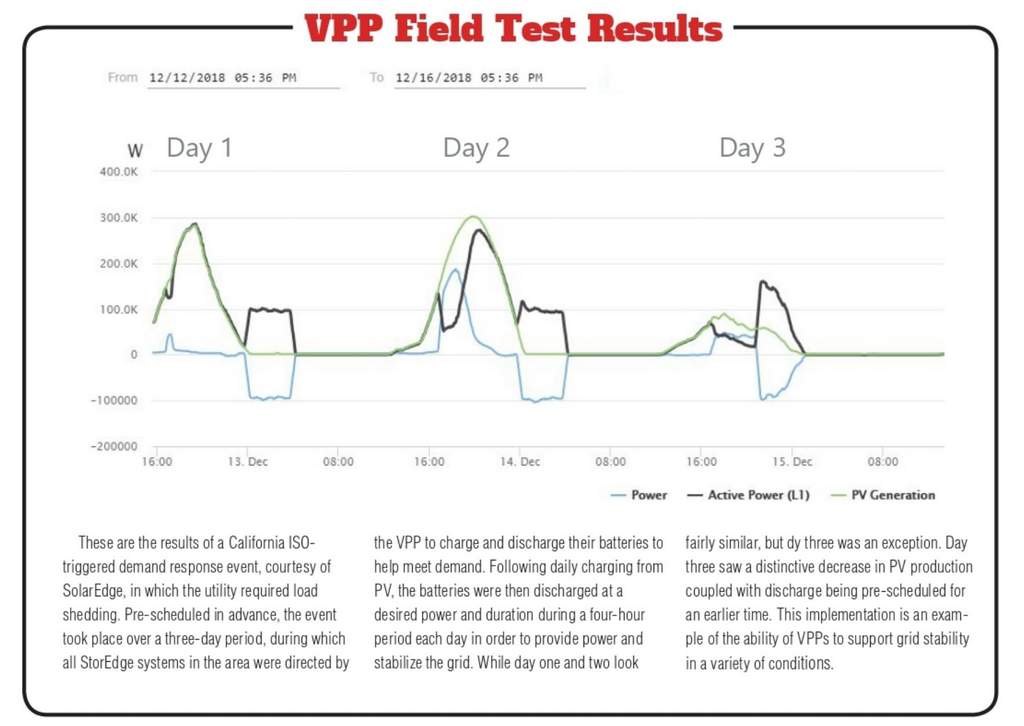

“The current conditions have lined up in the California energy market, making it ripe for the deployment of VPPs,” says Lior Handelsman, VP of marketing and product strategy and founder of SolarEdge. He points out how everything we’ve covered in the Countdown Series to this point contributes to this: a region with the highest level of PV penetration in the United States plus progressive changes like Rule 21 and Title 24. Meanwhile, adoption rates for EVs continue to rise, creating a need for additional power sources in order to prevent demand surpassing supply at peak charging times. SolarEdge provided us insight into one fleet of residential PV + battery systems configured as a VPP for a utility in California [see graph below].

“All these trends contribute toward California being able to smartly leverage its increasingly large pool of available distributed energy resources to support grid stabilization, just as the grid is now potentially facing one of its most challenging periods of instability,” Handelsman says. “By leveraging virtual power plants, California can support the transformation of its energy network into one based on distributed energy resources while the interest of prosumers aligns with utilities’ needs to modernize grid distribution.”

EBCE is one of California’s Community Choice Aggregators (CCAs), which are designed to leverage the buying power of large groups of electricity users to get lower prices while prioritizing distributed, renewable generation. In California right now, 19 CCAs are serving 168 communities and approximately 10 million customers, according to industry group CalCCA, and they could be a key driver of more VPP deals. CCAs are proving to be more innovative in their planning than utilities have been historically, mostly because it is why they exist. The CCAs’ procurement of battery energy storage — upward of 200 MW/800 MWh in one year, most of which is coupled with solar — is proving to be a case study that demonstrates the capability of CCAs to rapidly procure the resources the state needs to meet and exceed clean energy goals. With energy storage, CCAs are helping to break open a new market without having to depend on the lengthy cycle of utility procurement.

“There’s no way a utility is going to be able to do one-off contracts with every homeowner that has solar on their roof,” says Jen Szaro, VP of research and education for the Smart Electric Power Alliance (SEPA). “That’s a nightmare. It is going to be important to see how aggregators and CCAs can play a role in making those resources useful to the utility.”

Don’t wait — aggregate

Speaking of nightmares, John Rowland, president of S2A Modular, sees problems with California’s new-build mandate. “I think it may be a bit shortsighted because we have the highest home costs and a housing shortage, and then they tacked the solar mandate on it … Plus, builders aren’t very happy about this. They are doing the minimum they can. I don’t think that we’re going to see this mentioned until the post-2020 era, when we start seeing a lot of complaints because these initial new home systems aren’t doing what people think they’re going to do.”

In the picture he paints, less educated solar consumers will be moving into houses expecting closer to a net zero outcome, but not only will the systems not be large enough to do that on day one, many will be buying homes with cheap panels that degrade quickly.

This is a scenario S2A Modular is focused on avoiding with its Green Lux Homes, pitched as the first electrically self-sustaining, custom luxury homes. They are designed as the lowest amperage, lowest voltage, greenest homes in the industry and require no power from the grid. On the solar side, S2A has an exclusive deal to use a graphene solar product that Rowland says creates 30 percent more power than any other panel on the market.

“All of our homes produce excess power and income,” Rowland tells us. That last bit is what really intrigued us. “Unlike the California mandate, which only covers 18 to 33 percent of the power consumption of the home, our homes cover 100 percent, but produce on average $1,500 to $1,800 of income per year off the extra power we produce.”

Now, these are all still just plans as far as I can tell. S2A was unable to send over an operational case study to show proof of concept before presstime, and other California solar sources expressed skepticism about hitting those ROI goals, but the concept is worth relaying. So, with those caveats out of the way: Key to S2A’s revenue generation plan is Federal Energy Regulatory Commission (FERC) Order 841, which created a clear legal framework for storage resources to operate in all wholesale electric markets. S2A saw this as an opportunity to group their homes together as one renewable asset to contract with distributed energy resource providers (DERPs) in order to participate in the wholesale market. Under the current CAISO rules, DERPs must be able to manage a minimum of 500 kW at a time. Each S2A home included within a 500-kW group then gets a check for its portion as part of the whole.

“Each house, each community is an independent power plant, and these energy markets can purchase and buy back energy, and then we’re not using PG&E at all,” Rowland says. “We’re using football fields of storage that are set up to accept the power. We’ll be able to store all of our energy and dump at strategic times when it’s at its peak. It allows all of our communities and individuals to participate whether they have a small or large home.”

I don’t know the future of S2A’s specific vision, but the future of grouping and managing distributed resources (DER) will definitely open up a world of new possibilities.

Conducting the symphony

A recent Deloitte survey showed that 44 percent of electric utility executives would explore a DERM (distributed energy resource manager) solution over the next two years. Such a concept is proving itself out in Australia, in which one recent deployment will support thousands of distributed solar + storage systems. The glue holding that together is a DERM control solution from PXiSE Energy Solutions, a subsidiary of Sempra Energy. Their technology essentially brings standard transmission technology to the small scale to bridge the gaps that still exist between utility/grid operator concerns and renewable, distributed generation.

The utility sector sees safety, security, affordability and reliability as their top priorities, and then clean energy after that. Viewed this way, new technology has to prove worthy of those requirements, which is why PXiSE’s use of synchrophasors is intriguing. Also called phasor measurement units (PMUs), these are common in the transmission network game and provide real-time measurement of the electric qualities of the power grid, acting as a health indicator of sorts, to allow for two-way control of resources. PXiSE’s control system uses the time-synchronized PMU data from GPS-enabled protective relays to control grid devices. PXiSE describes it as the conductor at the orchestra.

“We can more precisely tune and orchestrate how these resources interact and support each other,” Patrick Lee, CEO of PXiSE, explains to us. “We pull in many different insights just from one or two high-speed sensors. It can pull in data at the speed of the grid — faster than the typical 3 second intervals — and can optimize around that data, reacting intelligently in sub-seconds to ensure efficient and reliable operations.”

If there is a disturbance on the grid, PXiSE can detect it coming down the line and transition immediately to a microgrid mode, or island a circuit or building, using the generating assets to provide power. When ready, it will reconnect automatically.

“I think we are at the beginning of a major grid transition … I am thankful for the work that’s been taking place in the industry in the last 10 to 15 years to build familiarity and workforce and shared knowledge around the value of storage and other clean energy tech because we no longer need to go into a room and explain the value,” Lee notes. “But the next shift is how we tie them together effectively. This is the next critical advancement we are enabling in the market.”

Barriers to entry

There’s a lot of innovation and ideas to be excited about. Taken together — new homes and businesses adorned with solar power and tied into storage systems to form a distributed amalgam of microgrids, DERMs, VPPs and other assorted acronyms — you can see a path for Jurich’s “fastest GW installed” blueprint to become the new expectation.

Unfortunately, as rapidly as technology evolves, markets shift and ice caps melt, the gears of regulatory change, by comparison, are churning slower than ever. The California Solar + Storage Association highlighted a handful of issues holding back behind-the-meter storage projects — despite FERC Order 841 — in “Barriers to Maximizing the Value of Behind-the-Meter Distributed Energy Resources.” The paper (which reminds one of reading Catch-22 in terms of procedural absurdity) outlines issues that cut across multiple policy areas under the California Public Utility Commission (CPUC) and the California Independent System Operator (CAISO) jurisdictions, including SGIP, NEM, demand response, resource adequacy, IDER and multi-use applications for storage, that all combine to hold back storage development. Dissecting it all would require another six- (or 60-) part series, but author Scott Murtishaw, senior advisor at CALSSA, sums it up a bit for us:

“A lot of the barriers that I mention in the paper are at the CAISO. For example, if you want to provide resource adequacy under the commission’s rules using demand response, it has to go through a supply side program, but CAISO designed those to fit the traditional demand response model. No provision for the potential export of energy was envisioned. This no export constraint substantially limits the capacity that behind the meter solar and storage can offer. The CAISO rules apply regardless of utility or CCA. Additionally, there are other barriers around interconnection and what you’re allowed to do under different interconnection agreements.”

The good news is these regulatory barriers to innovation are one area in which solar advocates and utilities are aligned. SEPA has made this a top priority with Renovate, its initiative to spur the evolution of state regulatory processes to enable innovation and allow for better decision-making practices.

“We are trying to get at how we improve the flexibility of the rule making process to allow people to be creative, take some risks, get things done quickly and move at the pace of the market,” Szaro says. “Take advanced metering for example. Utilities need regulatory approval to recover the costs of installing the meters, adding the back office capability to do billing and analyzing the data they generate. That data can be used to increase efficiency and potentially to add other new technologies to the grid. But because some of the benefits of advanced meters are ‘potential’ benefits, contingent on findings gleaned from data, they are difficult to quantify under traditional regulatory practices.”

SEPA’s Renovate Core Regulatory Problem Statements

1. People & Knowledge

The steep learning curve for policy makers, commissioners, commission staff, industry and other stakeholders in acquiring knowledge and understanding of new technologies, and their benefits and costs for customers can complicate and lengthen the decision-making process.

2. Managing Risk & Uncertainty

Current regulations and structures favor tried-and-true technologies, operations and approaches, in the name of prudence, strictly applying the “used and useful” principle. For new technologies and operating practices, there is uncertainty about the processes to identify and quantify benefits and costs, outline the full range of investment and operating options, and communicate and align incentives with agreed goals for the benefit of all customers.

3. Managing Increased Rate of Change

Regulatory proceedings on grid investments and customer programs often take so long that relevant technology providing customer benefit has advanced before a commission assessment can be completed or decision can be reached.

4. Complexity of Objectives / Cross-Coordination

Commissions have a mandate to serve the public interest, but increasingly, numerous priorities must be considered and balanced under an expanding definition of “public interest,” including: reasonable rates, customer choice, customer protection, environmental protection, current system structure, evolving system structure, with both short-term and long-term perspectives.

The goal is to identify a series of potential solutions for each of these problem statements by early 2020, giving states and jurisdictions a menu of options that apply to them.

Beyond 2020

The eleventh annual California Green Innovation Index, released by the nonpartisan nonprofit Next 10 and prepared by Beacon Economics, finds the state needs to reduce emissions by an average of 4.51 percent each year, marking a three-fold increase from the 1.15 percent reduction seen in 2017 to meet the requirements of SB 32, which raised the state’s emissions reduction goal to 40 percent below 1990 levels by 2030.

According to this index, California will meet its 2030 climate targets more than three decades late, in 2061, and could be more than 100 years late in meeting its 2050 target if the average rate of emissions reductions from the past year hold steady.

“California has made tremendous gains cutting pollution without detrimental economic impacts,” says F. Noel Perry, businessman and founder of Next 10. “The state’s per capita GDP has grown more than 41 percent while per capita greenhouse gas emissions have fallen by just over 25 percent since 1990. But this year’s index serves as a wakeup call. We’re going to need major policy breakthroughs and deep structural changes if we’re going to deliver the much steeper emissions reductions required in the years ahead.”

We launched the Countdown to 2020 series this year because California’s new build solar mandate was a dramatic enough change to the status quo that we envisioned it as the start of a cascade of changes for solar installers and the trajectory of the solar industry. We covered a lot of ground, from contemplating new solar installer and homebuilder business models to the role of DERMs in bundling neighborhoods together on the wholesale market. We have laid out every cool new idea, possibility and potential barrier to progress we came across.

Update: While some of its utilities try to undermine the new build mandate before it even starts.

And after six articles and over 12,000 words, we have reached the end, and I feel like the Game of Thrones writers. I have no satisfying conclusion. Actually, the better TV show analogy might be the Bob Newhart Show. The Countdown to 2020 was all a dream, and on Jan. 1, 2020, the Title 24 solar mandate arrives for real. It will be interesting to see how it all actually shakes out. As goes California solar, so goes the nation.

— Solar Builder magazine

Leave a Reply

You must be logged in to post a comment.