Solar modules manufactured in the United States are comprised of many components made beyond U.S. borders. The polysilicon to solar cell supply chain is the most high-profile example, but PV glass (requires a special sand to produce), sealants, backsheets, aluminum frames and so on are just as highly concentrated in China and Southeast Asia.

U.S.-based capacity for some of these PV components will come slowly (see Onshore Outlook for details) — except in the case of PV frames, which could be produced completely in the U.S. as early as 2024 as long as we switch from aluminum to steel.

At least that’s the pitch of Origami Solar, the 2022 winner of the Department of Energy’s American-Made Solar Prize.

The aluminum industry, and the aluminum PV frame supply chain, is centralized in China and Southeast Asia and has not evolved much in 20+ years. Steel manufacturing ecosystems on the other hand exist on every continent. This is a big reason why solar industry veteran and Origami founder Eric Hafter set his sights on steel solar frames and pitched the idea to now-CEO Gregg Patterson and chief strategy officer Erick Petersen.

The team envisioned a complete disruption of the aluminum PV frame market — a combination of product innovation and established U.S. industry that could support 100% of the U.S.-based module manufacturing capacity with domestically produced PV frames.

Localization is only part of the pitch in the switch to steel frames. The rest includes lower costs, lower greenhouse gas emissions and improved structural reliability.

Here’s everything you need to know.

Steeling market share

We’ll get to the performance, cost and GHG benefits, but understanding the potential for a swift and total adoption of steel frames by U.S. module manufacturers — overcoming the 45-year head start of aluminum — is the most intriguing tidbit considering the preliminary guidelines for the 10% domestic content tax credit adder.

“We’ve spent a lot of time wondering, ‘how do you enable the solar industry to scale as quickly as they want to?’” Patterson asks. The answer is engaging the U.S. steel industry. “Our strategy is holistic — don’t just create a product. We need an upstream supply chain, and we have to make sure the outcome exceeds the end customer’s expectations.”

They started talking to the biggest steel and coating companies in the U.S. and Europe, as well as a large number of roll-forming fabrication partners. By lining them up, Origami Solar has addressed assurance of supply and eased a main point of resistance from the module manufacturers, who can then hit the ground running with serious volume if they want to make the switch.

“Module companies have never had steel in their commodity portfolio, and we’re asking them to transition from a commodity and component that’s been in place for 45 years,” Patterson notes. “So, we have to create and build that capacity.”

The steel industry is practically giddy about the opportunity. The forecast for U.S. solar installed over the next five years is anywhere from 30 to 50 GW of capacity annually. At just 30 GW, that’s a potential 350,000 tons of steel needed per year.

For the fledgling U.S. solar module manufacturing industry, the timing is nearly perfect. Many facilities are coming online or expanding in the next few years, and they need as much domestic content as possible in the final product.

“The solar industry is good at adopting a better solution quickly,” Patterson says. “We have educated the solar industry to the point where they view steel as a viable alternative with a superior value proposition, and some believe it is the preferred alternative.”

He estimates that 2024 is when we can expect the start of the transition to steel. Now, let’s get into all of the reasons why.

Glass on the border

Canadian Premium Sand Inc. is developing a new facility to produce patterned solar glass for the growing footprint of North America-based solar module manufacturers and recently signed three significant offtakers: Hanwha Solutions Corporation (Qcells), Heliene Inc. and Meyer Burger Technology AG. Canadian Premium Sands and its EPC consortium have designed an 800 tonne per day solar glass manufacturing facility — that is approximately 6 GW per annum of solar panel manufacturing capacity in North America. These three North American solar panel manufacturers account for a combined 62% of planned output capacity and an average renewable contract term of over 4 years.

Advantages over aluminum

Localizing and derisking the supply chain of solar module frames provides value well beyond the political talking points of domestic manufacturing.

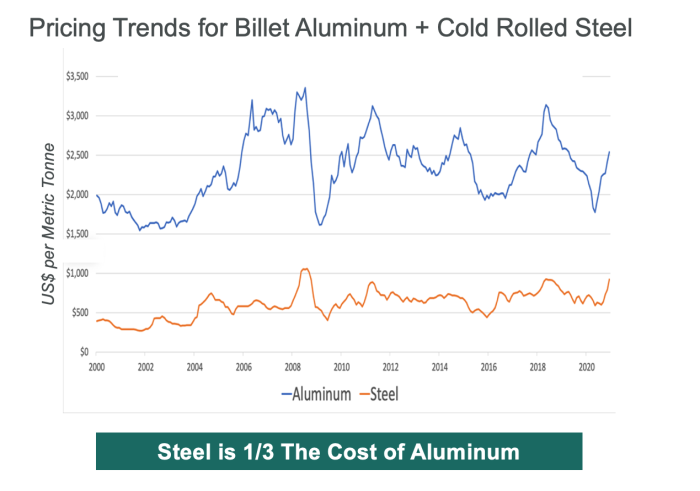

Lower cost | Aluminum is about 3x the cost of steel on a per-pound basis. On top of that, the steel roll-forming production process is much simpler, faster and more cost-effective.

To extrude an aluminum frame, an ingot is pressed through a heated die to get a basic shape. It is then anodized for corrosion protection (or anodized even longer to achieve a black look for residential). Then, it is cut to size. Then, all of the holes and slots are punched for fabrication.

“With roll-formed steel, you put a coil of corrosion-coated steel on the front end, and what comes out the back end are the frame components — the long sides and the short sides with all of the holes and slots punched into them,” Patterson says.

This lower-cost starting point in 2024 is also the most expensive the frame will ever be, as it will surely come down after the steel frame ecosystem and fabrication process are optimized and volumes increase over the years.

Durability | “We thought through everything that a frame needs to do holistically, including the cost to install and maintain,” Patterson says.

Testing of the first-generation steel frame design conducted at TECSI Solar compared a 35 mm tall Origami steel frame against a 40 mm aluminum frame under identical conditions and using identical PV laminates. Report findings:

- Top clamping: Steel frames were tested for compression strength to support typical top clamp loads, which could result in frame buckling or laminate breakage. The Origami steel frame delivered more than sufficient rigidity and stability to resist such loads.

- Downforce: The Origami steel frame significantly outperformed the taller aluminum frame in frame wall rigidity, structural stability and total deflection, even at a 150 psf load. The solar- active components of the PV laminate were far better protected from possible damage as validated in EL imaging tests.

- Upforce: The Origami steel frame again outperformed standard aluminum frames, withstanding upforce loading to 135 psf.

- Laminate rigidity: The Origami steel frame maintained laminate rigidity better than aluminum, better protecting the solar cells from cracking under downward loading.

A caveat to these results: That was the beefed up “Sherman tank” prototype. The Origami team is now on version 2, which uses a lighter gauge steel that has proven to be even more structurally sound in their FEA [finite element analysis] tests.

Version 2 adds about 1 lb. to an average residential small module and 4.5 lbs. to a large-format module. Considering the growing concern about the fragility of supersized modules [see p. 44], those extra pounds might be a fair trade.

“The feedback we’ve received from a lot of players is that’s totally within reason,” Patterson tells us.

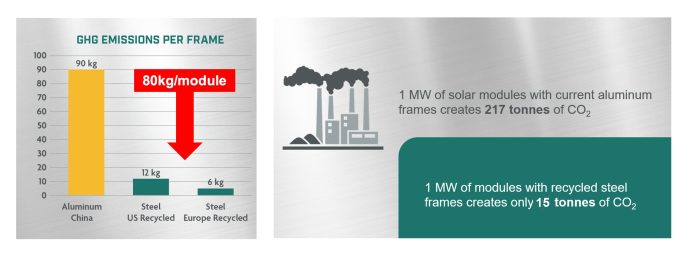

Embodied carbon | Aluminum is an energy intensive, CO2-heavy production process, especially for a commercial product of this scale.

A comprehensive life cycle analysis (LCA) report from Boundless Research indicates a steel PV frame would reduce solar module embodied GHG emissions by ~90% vs. aluminum frames imported from China and Southeast Asia. The potential GHG emission savings from replacing only 10% of the industry’s conventional aluminum solar frames with Origami Solar steel module frames is approximately 30 megatons (30 million metric tons) between 2022 and 2030 — the emissions equivalent of eight coal-fired power plants for an entire year. A 50% shift to steel would result in a GHG reduction of 148 megatons.

This is another metric that will only improve over time as steel companies continue to decarbonize their own production processes. The solar industry does utilize lower-carbon recycled steel for tracker, racking and other structural components, and has the opportunity to reduce embodied carbon intensity significantly more if recycled steel were also used for module frames.

Framing the conversation

Solar is being set up to be a major industry in the United States. The spotlight on the supply chain and how solar modules and large-scale plants perform is only going to intensify. Steel PV frames could shore up (and on-shore) an inherent weak spot in the current industry. This is the potential that sealed the DOE American-Made Solar Prize last year, and why the support is rallying for Origami’s innovation.

“The solar industry has been around for 45 years,” Patterson notes. “In those 45 years, we got to 3% of total power portfolio worldwide. Projections are that solar ideally needs to get to 40 to 70% in the future. That’s causing a maturation in how we look at it, from a long-term performance and consistency perspective. It’s got to be bulletproof. We have to think about the details that haven’t been essential when you’re at 3% that will be essential at 40%.”

Chris Crowell is Editor-in-Chief of Solar Builder.

— Solar Builder magazine

Leave a Reply

You must be logged in to post a comment.