Some state incentive programs for commercial energy storage may seem at times to lack enough financial reward to encourage adoption of new capacity, but a new program from Efficiency Maine puts the numbers upfront with potential savings of up to $3 million per participant over five years.

The quasi-state organization is offering the incentives within its Energy Storage System Program to commercial power customers that help reduce the state’s peak consumption of electricity from the ISO New England grid. Energy consumption reduction behind the meter during summer and fall peak periods will earn new storage adopters $1,000/kW of eligible capacity with a 5-year contract.

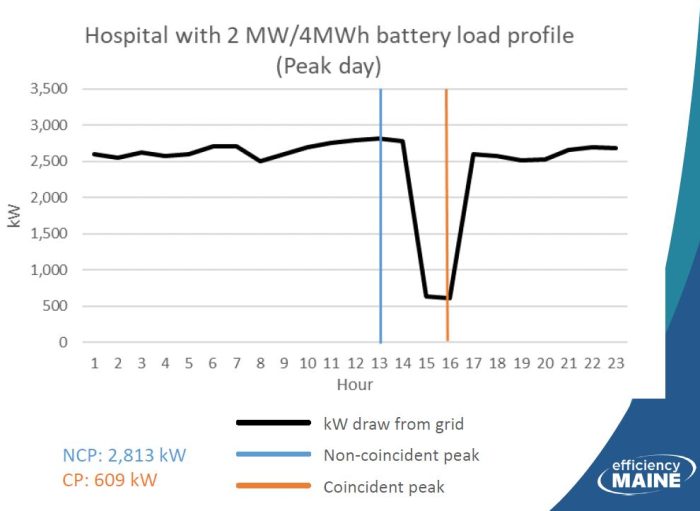

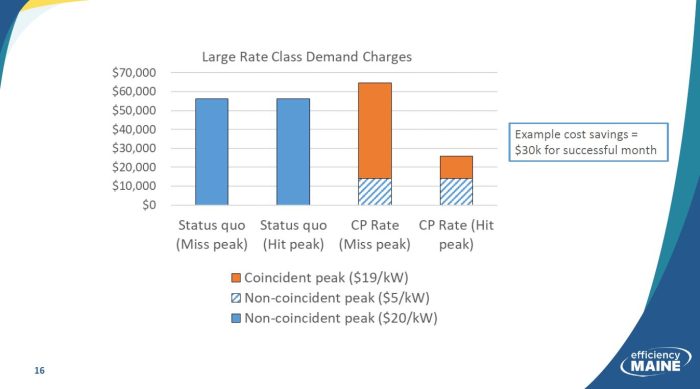

This new program is currently focused on customers that qualify for a new electricity rate from Central Maine Power (CMP) keyed to shaving multiple utility demand rate peaks per year. A typical commercial electricity customer with a $50,000 monthly bill could save $30,000 per month in the program, said Jesse Remillard, a senior program manager at Efficiency Maine, in a September 28 webinar posted by Clean Energy States Alliance.

“We in Maine are already starting to see the duck curve show up here on the main load profile, like California, so energy storage can help smooth the transitions. Storage also is a way to provide a measure of resiliency and backup power at a facility level,” he said.

The Efficiency Maine Trust (aka Efficiency Maine) is an independent agency established to plan and implement energy efficiency programs in Maine with oversight from the Maine Public Utilities Commission. Clean Energy States Alliance is consulting for Efficiency Maine in the program, and DNV is the contract program manager.

Anticipating Peak Days?

Unlike other state storage incentive programs in which the utility or some other grid entity identifies the specific days on which storage customers are asked to use their batteries, the Maine program relies on the storage system vendors or other analysts to predict when the days will occur, based on historic data.

Reliance on that data should mean that participants in the new program can predict with 90% accuracy which days they should switch to storage, Remillard said.

To qualify for the incentive, participants with at least a 20 kW system must hit 15 of CMP’s peak days during a three-hour period, typically occurring during June, July, August and September. Targeted participant performance is determined by data sent to Efficiency Maine from each customer on 15-minute intervals. Compensation is only for energy demand reduction behind the meter, not for electricity export to the grid.

Four-Year Storage Payback

In a hypothetical example, Remillard suggested that a commercial facility with a 700 kW peak load should install a 500 kW battery bank capable of discharging for three hours, or a 1,500 kWh storage system. Based on an estimated cost of $750 per kWh, the total system cost would come in at about $1.1 million, he reckoned.

With a potential incentive of $500,000 over five years for that sized system, plus a 30% ITC tax credit of $337,500, the net cost of the system would only be $287,500, Remillard calculated. Another $77,400 in annual rate savings would sum up to a 3.7 year return on equity, he concluded.

To participate in the program, pre-approval of the ESS is required. The system must maintain a minimum 80% efficiency round-trip, and carry a 10-year manufacturer’s warranty plus UL-type certification.

Ambitious State Storage Goals

The new Efficiency Maine storage program is only one of the measures likely to be seen in the state over the near term. The State of Maine has by law established energy storage capacity goals of 300 MW by the end of 2025 and 400 MW by the end of 2030.

The 400 MW goal will represent nearly 20% of Maine’s peak demand as of 2021, according to Governor Janet Mills’ office. To shape these goals, the state retained consultants from Energy & Environmental Economics (E3). They produced the state’s Maine Energy Storage Market Assessment in March 2022.

That report observed that: “In Maine, some of the highest value services for certain projects in the near-term may be avoided transmission and distribution (T&D) infrastructure costs. However, realizing these avoided costs by specific storage projects will depend on the ability to site storage in the most valuable locations and on potential business model and/or regulatory changes to help these benefits to be monetized.”

The report also recognized the potential for energy storage aggregators in the state electricity market.

“Recent policy and market changes in ISO New England, the region’s independent system operator, are allowing customer-sited (also referred to as behind-the-meter or BTM) storage to participate in wholesale markets through aggregation, i.e. grouping together smaller projects that individually may lack scale and coordination necessary for proper market participation. This provides alternative revenue

streams for customer-sited storage. While these revenue streams are lower today than customer bill savings, they provide customer-sited storage investments optionality and alternative revenue streams that increase their overall attractiveness,” the report notes.

More broadly, the state’s four-year climate action plan, Maine Won’t Wait, update in early 2022 identified 50 MW of storage capacity in operation.

The total will rise rapidly, since “hundreds of megawatts of additional planned projects are in the ISO-NE interconnection queue,” Mills’ office reports. “Recently, the regional capacity market saw over 700 MW of energy storage resources clear in the 2022 (FCA 16) auction, including over 200 MW in Maine,” the office adds.

— Solar Builder magazine

Leave a Reply

You must be logged in to post a comment.