A good starting point for identifying an advantageous solar market is to look at the average retail cost of electricity. For behind-the-meter (BTM) solar projects, high retail electricity prices enable solar project economics to look more attractive. The opposite is also true. Low prices make it hard for projects to pencil out. This is a primary reason why the Midwest rooftop solar market has lagged behind other regions of the country that have experienced more rapid growth.

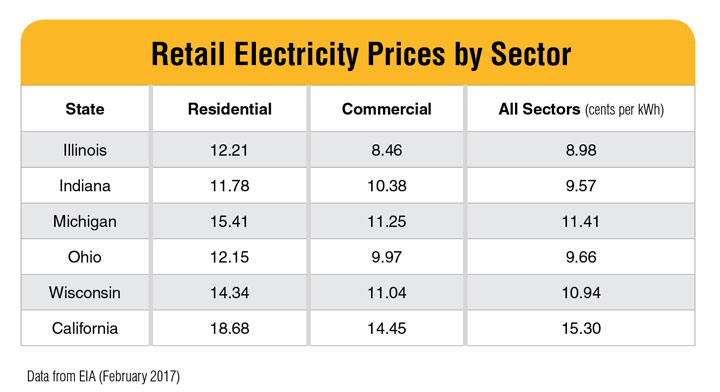

The U.S. Energy Information Administration (EIA) is a great resource for sourcing impartial information on energy costs throughout the country. EIA publishes a monthly report which shows the average price of electricity for each state by sector of use. Below is a summary of EIA energy cost data for the five biggest Midwestern states, in comparison to California, the leading BTM solar state in the country.

Looking at the average retail electricity price by state provides a high-level filter for identifying viable BTM solar market opportunities. But the statewide average blended rate does not tell the full story. In order to really pinpoint tangible customer opportunities, we need to look at both the utility level and rate tariff level. It is not uncommon for there to be a wide amount of variance between different rate schedules within a given state. For example, the average residential cost of electricity could be 13 cents per kilowatt-hour, but specific rate schedules could range from under $0.10/kWh to over $0.20/kWh.

It’s also important to point out that the average cost of electricity is not the same as the average blended savings of a solar project. When it comes to quantifying how much solar is worth, average blended savings, which is sometimes referred to as the value of solar, is the truest representation of value. The calculation for average blended savings is very simple: first year dollar savings divided by total first year solar production. This expresses the value of solar on a $/kWh basis. We published a video tutorial entitled “How to Accurately Calculate the Avoided Cost of a Solar Project,” which explores this concept in depth.

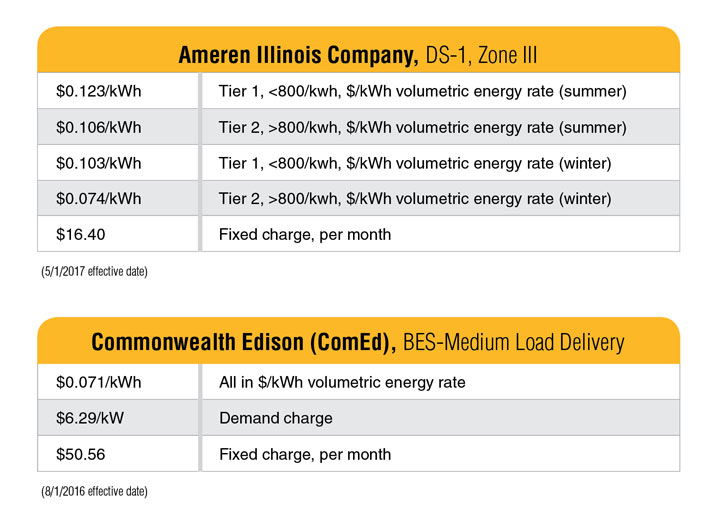

Accurately calculating the value of solar for a specific customer requires good software. This is especially true in instances where the utility rate tariff is complex, like a rate schedule that has time-of-use (TOU) rates, demand charges or an inclining or declining block structure. Energy Toolbase specializes in objectively quantifying the avoided cost on complicated rate structures. Our software platform is used by solar companies of all shapes and sizes in markets throughout the United States to accurately and transparently determine savings for a given customer. Let’s look at two rate schedules in the state of Illinois.

The Ameren Illinois Co. rate schedule features a declining block structure, meaning the energy used above the 800 kWh threshold is priced at a lower rate. Assuming a high usage customer of 1,250 kWh month of usage, Energy Toolbase calculated the customer’s average blended cost of energy at $0.114/kWh. Assuming an 11.2 kW DC solar system, which offsets 90 percent of annual kWh usage, the value of solar is calculated at $0.102/kWh. Note: In a deregulated state like Illinois, be mindful of which entity is billing the generation supply charge, which will affect the customers’ $/kWh volumetric energy rate.

The ComEd, BES-Medium schedule is a typical C&I rate in that it has $/kWh energy, $/kW demand, and $ fixed charges. Assuming a customer uses 10,000 kWh month and a peak demand of 50 kW, Energy Toolbase calculated the customers average blended cost at $0.108/kWh. Assuming an 80 kW DC rated solar system, offsetting 80 percent of annual kWh usage, the value of solar would come in at $0.079/kWh.

These are two generalized examples. Other customers on these same rates could have very different average blended cost and value of solar calculations, especially if the $/kWh generation supply charge was meaningfully different. Therefore, when searching for favorable market opportunities we recommend running several sample projects to establish the range for both cost and savings.

Adam Gerza is the COO of Energy Toolbase, a software platform for modeling and proposing the economics of solar and energy storage projects. To learn more about Energy Toolbase and sign up for a free trial, visit www.energytoolbase.com.

— Solar Builder magazine

[source: https://solarbuildermag.com/featured/midwest-solar-customer-acquisition/]

Leave a Reply

You must be logged in to post a comment.