Despite missing its earnings forecast targets and not meeting analyst expectations, SunPower still had a pretty solid 2019. It is still figuring out the mechanics of spinning off its PV manufacturing business late last year, but the company’s full-year 2019 earnings report shows a big bump in its residential solar installation business and encouraging demand on the commercial side — although the latter only served to highlight issues in its project execution that need to be addressed.

Fourth Quarter 2019 results

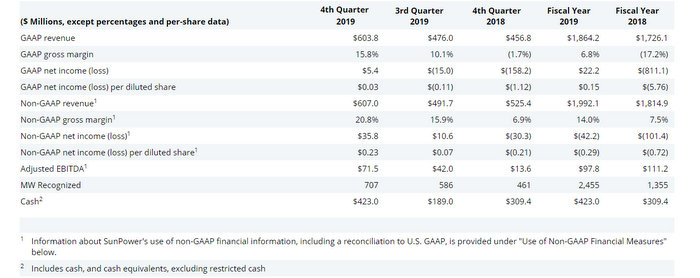

SunPower’s revenue rose to $603.8 million from $456.8 million in the year-ago quarter.

“Overall, we exited the year with solid fourth quarter financial performance despite execution challenges in our commercial direct business,” said Tom Werner, SunPower CEO and chairman of the board. “We also achieved a number of important strategic milestones during the quarter. These included the announcement of our proposed Maxeon Solar spin-off and planned equity investment from TZS, initial installations of our residential Equinox Storage system, as well as a successful capital raise and partial convertible bond retirement to further strengthen our balance sheet.”

Residential revenue hit a record to close out the year with 27% MW Q4 growth vs. the year-ago quarter.Werner points to the strategic decision to combine its residential and commercial dealer operations into a combined channels business [SunPower Energy Services (SPES)] played a big part.

“Our residential business achieved record revenue and installation volume, and in new homes, we remain the market leader as we grew this business by more than 50 percent last year and exited 2019 with a backlog of 45,000 homes,” Werner said. “We expect new homes volume growth to exceed 50 percent in 2020 as we leverage the current California new home solar mandate. Finally, we remain very excited about the launch of our Equinox Storage product as we added to our beta installations in the fourth quarter and see strong demand for Equinox Storage in 2020.”

The commercial side was a mixed bag in that SunPower received a lot of business, but then ran into a lot of delays and execution issues.

“In Commercial Direct, we maintained our market share lead and increased installation volume year over year. Our origination teams once again performed well, but deployment execution remained challenged,” Werner said.

As a result of this underperformance, the company is making some process changes. including changes to its reporting structure, instituting new processes to streamline permitting and regulatory requirements and actions to improve installation execution.

“We now expect our commercial direct business to return to profitability in the second half of this year,” Werner said. “Demand for our Helix Storage solution remains strong as evidenced by our plan to add 20 megawatt hours (MWh) of storage to the Chevron Lost Hills solar project, our largest commercial storage award to date. Additionally, our storage pipeline continues to expand, now exceeding 175-MW with attach rates of 35 percent.”

SunPower Technologies (SPT)

SPT beat the company’s financial targets across the board including volume, revenue, margin, EBITDA, and cash flow. Growth was driven primarily by demand in the global DG markets, with DG volume up over 95 percent year-over-year. For the full year 2019, DG shipments grew approximately 75 percent.

“During the fourth quarter, we completed commercialization of our Maxeon 5 technology, ramping our first line-pair to full production,” Werner said. “Customer demand for this product is strong, and the technology is ready for accelerated ramp consistent with the planned $298 million equity investment from TZS. Demand for our Performance Series (P-Series) product also remains high, comprising approximately half of our fourth quarter and full year 2019 shipment volume.”

Financial Outlook

The company’s first quarter 2020 GAAP and non-GAAP guidance is as follows: on a GAAP basis, revenue of $435 million to $470 million, gross margin of 3 percent to 6 percent and net loss of $85 million to $70 million. On a non-GAAP basis, the company expects revenue of $435 million to $470 million, gross margin of 9 percent to 12 percent, Adjusted EBITDA of ($15) million to $0 million and MW deployed in the range of 520 MW to 570 MW.

The company’s fiscal year 2020 GAAP and non-GAAP guidance is as follows: on a GAAP basis, revenue of $2.1 billion to $2.3 billion and a net loss of $195 million to $145 million. On a non-GAAP basis, revenue of $2.1 billion to $2.3 billion and operational expenses of less than $260 million. Gigawatts recognized is expected to be in the range of 2.5 GW to 2.75 GW and capital expenditures of approximately $100 million.

As a result of the restructuring of its commercial direct business, the company expects fiscal year 2020 Adjusted EBITDA guidance in the range of $125 million to $175 million.

— Solar Builder magazine

Leave a Reply

You must be logged in to post a comment.