On May 12, the United States Treasury Department issued its long-awaited domestic content guidance for solar projects to qualify for associated Inflation Reduction Act (IRA) tax credits. In order for the whole cost of a module to be considered domestic content, not only must the module assembly be undertaken in the U.S., but the cells, frame or backrail, glass, backsheet, encapsulant, junction box, edge and potting sealants, adhesives, bussing ribbons and bypass diodes must also be manufactured in the U.S.

For those modules that don’t fully qualify, some more limited credit can be received for U.S.-sourced components based on their value. How much of a typical U.S.-assembled solar module is likely to be “domestic content” then? Alex Barrows, Head of PV at Exawatt, provided Solar Builder with this context:

U.S. cell capacity

While U.S. silicon-based module capacity is now due to reach close to 50 GW by the end of 2025 (plus ~10 GW of thin-film capacity from First Solar), cell capacity announcements have trailed far behind. Even if all announcements come to fruition, capacity is only set to reach 15 GW. All of this capacity is planned to be integrated with module capacity, meaning U.S.-made cells currently look unlikely to be available to buy.

Additional cell capacity expansions may yet be announced, but if manufacturers are looking at establishing cell capacity in order to qualify as a domestic product, they’ll need to be confident that they can source the other components.

U.S.-made components

Unsurprisingly, at the time of writing, the U.S. supply chains for the relevant components are limited at best, and non-existent at worst.

Glass is liable to prove a challenge. We believe there is essentially no PV glass capacity currently operating in the U.S. other than the specialist production used by First Solar. Not only is glass a big cost component, but it’s capital intensive and slow to establish, so glass manufacturers will want to be sure of stable and lasting demand.

Manufacturing frames in the U.S. shouldn’t be a huge challenge, but it could be expensive. As an alternative to aluminum, we’ve seen a number of major manufacturers globally launch steel-framed products in recent years, and we could well see more of this in the U.S. as manufacturers explore these options.

Backsheet and encapsulant should be feasible in modest timeframes, but with limited capacity currently running in the U.S., manufacturers will have to wait.

We believe that sealant is already available, and adding bussing ribbon, bypass diodes and junction box manufacturing to the U.S. should all be doable, albeit with a cost and price premium. However, the relevant manufacturers are only likely to take the plunge on these if they see sufficient pull from the module makers – and that is only likely to come if sourcing of the big ticket items of glass and frames can be solved at acceptable cost.

PV module costs

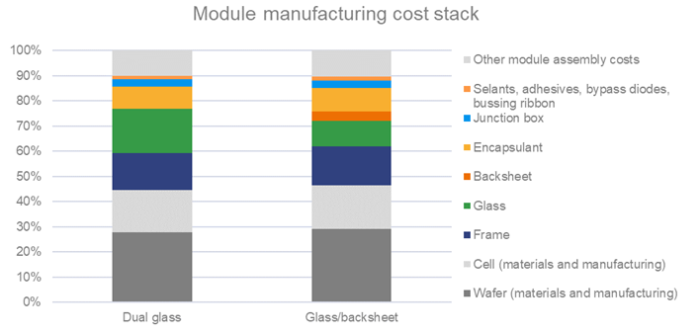

So how do the costs of these components look as part of the total cost of manufacturing a module? This depends on a host of factors, from the integration strategy of the manufacturer (i.e., whether they make wafers and cells in-house) to the materials and procurement choices that the manufacturer makes.

As a guide, the chart below shows the approximate cost breakdown of module manufacturing from the point of view of an integrated manufacturer in SE Aisa, with the components relevant to U.S. domestic content highlighted.

And just in case anyone was hoping for some certainty, the rules could still change over the coming months.

Alex Barrows is Head of PV, Exawatt. For those interested in more details, watch out for Exawatt and PVEL’s quarterly Solar Technology and Cost report.

— Solar Builder magazine

[source: https://solarbuildermag.com/pv-modules/u-s-solar-modules-and-the-domestic-content-challenge/]

Leave a Reply

You must be logged in to post a comment.