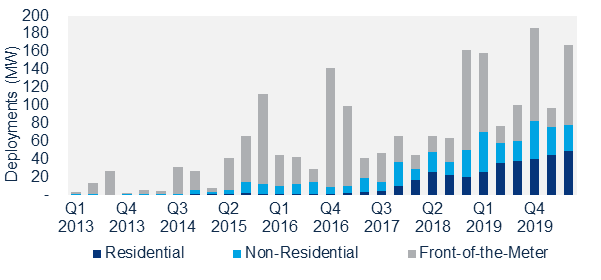

According to Wood Mackenzie and the U.S. Energy Storage Association’s latest ‘US Energy Storage Monitor’ report, 168 megawatts were deployed in second quarter of 2020. This is an increase of 72% quarter over quarter, 117% year-over-year and is the second-highest quarterly total ever seen, falling just behind the fourth quarter of 2019, which totalled 186.4 megawatts.

One large front of meter project coming partially online in California, accounting for more than two-thirds of the total megawatts deployed, helped to drive this level of quarterly activity. The large-scale system puts California back on the map after a quiet 2019 and, according to the report, the state is expected to remain there over the next six quarters.

The US front of meter market grew more than fourfold compared to Quarter 1. Deployments notched their fifth-best quarterly total of 89.8 megawatts, the largest quarter on record.

Another record quarter for residential storage deployments, which increased 28% year over year, illustrates that California and Hawaii successfully kept installations progressing even through recent coronavirus lockdowns.

“We are encouraged by the growth the energy storage market has seen this quarter,” said Kelly Speakes-Backman, CEO of the U.S. Energy Storage Association. “Despite any setbacks from the coronavirus pandemic, the market for energy storage is poised to see significant growth in 2020. Looking out to future growth, we are confident that our expanded vision of 100 gigawatts of new energy storage by 2030 is entirely reasonable and attainable, pushing us closer to reaching a more resilient, efficient, sustainable and affordable electric grid.”

Dan Finn-Foley, Wood Mackenzie Head of Energy Storage, said: “The US energy storage market has proven remarkably resilient to impacts from coronavirus lockdowns. The commercial and industrial (C&I) space was the only segment that showed a slowdown. This was primarily because of a decline in the C&I commercial and industrial space California market due to permitting and other delays. We expect the rest of the year to come in strong as growing interest in residential storage, emerging new markets for C&I commercial and industrial space and massive FTM systems are set to break quarterly records.”

The non-residential market demonstrated more volatility than the residential market in the second quarter of 2020.

At 29.5 megawatts, the segment notched its second quarterly decline in deployments. Quarterly deployments fell by 7% quarter over quarter as the market absorbed the shocks from coronavirus lockdowns more acutely than the residential segment. However, despite the segment’s setback, it still achieved its fifth-highest level of quarterly deployments thanks to surging installations in Massachusetts.

With Q2 deployments setting a record this year, Wood Mackenzie and ESA forecast the US energy storage market to grow significantly over the next six years.

The US market will grow more than sevenfold by 2025 compared to the annual market in 2020. In that timeframe, megawatt hours growth is expected to accelerate faster than megawattage growth as average discharge durations increase over time due to a focus on services such as capacity increase.

The front of meter segment will continue to make up the bulk of the market through 2025, driven by massive investment from vertically integrated utilities in regulated markets and developers taking advantage of wholesale market opportunities and incentives in key markets.

The residential segment is expected to continue its upward trend, beating its 2020 numbers sixfold in 2025. The non-residential segment will see an annual market in 2025 that is eight times bigger than the 2020 market.

A significant amount of non-residential upside is tied to community solar-plus-storage. The majority of this is concentrated in Massachusetts and New York and driven by those states’ strong incentive programs and access to wholesale markets.

— Solar Builder magazine

Leave a Reply

You must be logged in to post a comment.