In its just-published PV Structural Balance of System (SBOS) Report for North America, IHS Markit forecasts the market at $8.3 billion from 2018 to 2022, to be driven by demand for single-axis trackers. The blended average pricing across all product segments (roof-top and ground-mount) is expected to fall from $0.13/W to $0.09/W during the period.

What happened in 2017?

• In 2017, more than 11 GW of PV racking and mounting products were delivered in North America, a decline of over 20 percent from 2016 due to lower demand for ground-mounted products.

• The competitive landscape for PV structural BoS in the United States experienced year-over-year consolidation in 2017, with the top ten suppliers accounting for 85 percent of shipments for the year. NEXTracker, RBI Solar, Array Technologies, SunLink, and IronRidge were the five largest suppliers and collectively accounted for over 60 percent of the market in 2017.

Market demand forecast

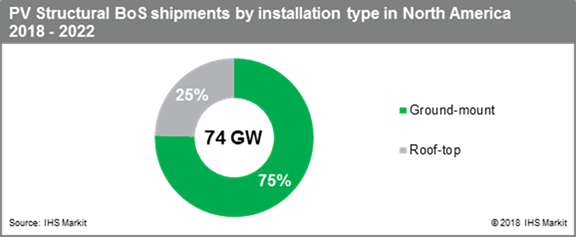

• The size of the PV structural BoS market in North America is forecast to surpass 74 GWdc from 2018 to 2022, with the ground-mounted segment accounting for 75% of demand.

• Demand for PV structural BoS products in the United States is forecast to peak from 2020 to 2021 before declining in 2022 due to the influence of the Federal Investment Tax Credit (ITC).

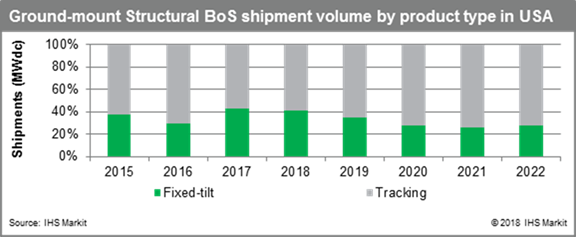

Single-axis tracker domination

• Single-axis trackers have remained the dominant PV mounting product type in the United States, accounting for 56% of the ground-mounted segment in 2017 and are forecast to account for 69% of the segment from 2018 to 2022. The utility-scale PV ground-mount segment is projected to experience even higher attach rates for tracking systems, eclipsing 81% by 2021.

• The strongest cost benefit of utilizing single-axis trackers is in the Southwestern United States, but markets across the Western and Southeastern United States also provide attractive opportunities for tracking systems compared to fixed-tilt, albeit the cost-benefit in such regions is weaker.

• The market for fixed-tilt PV systems has remained stable due to strong market share within the small megawatt-scale market (system sizes 1 MW to 20 MW) and in key emerging utility-scale markets such as Florida associated with land types and seasonal conditions that are less conducive for tracking systems.

Rooftop demand

• Roof-top PV accounted for 3.6 GW of PV structural BoS shipments in 2017, primarily driven by demand for residential pitched-roof systems in the United States.

• Railless solutions lost market share in the pitched-roof segment in 2017 primarily due to the pull back of large railless customers such as SolarCity/Tesla and Vivint Solar, though multiple suppliers launched or experienced a higher sales volume for railless solutions during the year.

— Solar Builder magazine

Leave a Reply

You must be logged in to post a comment.