Solar experts fear newly released guidance on the Inflation Reduction Act (IRA) tax credits will limit the industry’s ability to serve low-income communities. Under the new guidance, most households will have to prove their low-income status, which has been shown to substantially limit a household’s willingness to sign up for community solar plans that can lower their energy bills.

- In August, the U.S. Department of the Treasury and the Internal Revenue Service (IRS) released additional guidance about the Low-Income Communities Bonus Credit program under Section 48(e) of the Internal Revenue Code.

- The program provides an Investment Tax Credit boost of up to 20% for 1.8 GW of qualified solar or wind facilities.

- 700 MW of the benefit is allocated to facilities where at least 50% of the financial benefits of the electricity produced go to households with incomes below 200% of the poverty line or below 80% of area median gross income.

“The sad part about the federal guidance on the low-income tax credits in the IRA is that you have to ask low-income customers to give you their financial documentation to prove they are low income,” Steph Speirs, cofounder and CEO of community solar customer acquisition and management service provider Solstice told Solar Builder Magazine. “You need their W2s, you need their tax returns. And our data shows that if you ask a customer for documentation, ask them to prove they’re poor, 2.3x fewer low-income customers sign up compared to geo qualification.”

The documentation requirements sparked concerns because low-income households are much more likely to sign up for community solar when the only criteria is geographic—living in an area where most households are low-to-moderate income—or self-attestation.

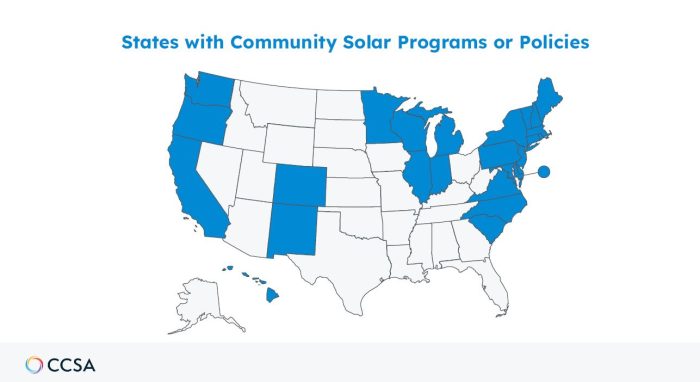

“The best way to do this self-attestation, which means when you ask somebody if they’re a low-to-moderate income customer, they can just tell you either yes or no,” said Matt Hargarten, vice president of campaigns at the Coalition for Community Solar Access (CCSA). All the evidence shows “people will not claim to be poor unless they are poor,” he said.

Although the new guidance calls for proof of income, there may be a workaround in some states or for some households.

Hargarten said CCSA is “working with states and the federal government to find the easiest way to sign up customers because not only are these types of customers very expensive to find and sign up, but they also have historically been taken advantage of when having to give confidential information.”

Speirs said the guidance allowed the two states that had already approved self-attestation to continue the practice, and Hargarten said that in a number of states, if someone is already in the federal government’s Low Income Home Energy Assistance Program (LIHEAP) program, they will be able to automatically enroll and use LIHEAP dollars for community solar.

“There are other state and federal programs where the government has already done that verification where, if we can utilize that verification as eligibility for community solar, that would also be good,” Hargarten said.

Designing community solar programs that help, not harm, low-income households has been a learning process.

State program design varies. Factors that have limited uptake include:

- requiring proof of low income or credit scores above 680,

- allowing steep termination fees,

- not offering significant discounts,

- requiring the community solar farm be in the same county as subscribers, and

- having caps on the amount of community solar.

Those factors either make it less attractive for subscribers or create hurdles for developers.

Without good policy design, developers may take the shortest path to filling a community solar subscription.

One example: Minnesota’s community solar program prior to legislation passed earlier this year to fix it, Hargarten said. “They set up a community solar program, and they didn’t specify how many actual small customers need to be signed up. And so, what did the developers do? Well, they signed up large commercial subscribers, because it was easy and cheap. And that’s what the private market will do: they’ll go to the most efficient way.”

The new federal guidance is not all bad news.

Speirs praised it for mandating a meaningful minimum discount for low-income community solar subscribers. “It mandates that if you’re going to get the low-income tax credits, then you have to give people 20 percent bill discounts. In most states that have community solar legislation, most of the time you see ten percent discounts for mass market. So, the idea is that you get a better discount if you’re low income.”

In a press release, Deputy Secretary of the Treasury Wally Adeyemo said the bonus tax credit “will drive investment to underserved communities to ensure they benefit from lower energy costs and reduced pollution and health hazards. Treasury has worked to get this program off the ground as quickly as possible, and in partnership with the Department of Energy (DOE), will be opening the application process and making awards to projects earlier than initially anticipated.”

Despite his claim that applications and awards are moving faster than planned, the guidance may stymie subscriptions to community solar, with the unintended consequence of slowing down deployment.

“If we burden low-income customers, it’s harder for them to sign up, and then we shoot ourselves in the foot because then it’s harder to get these projects built,” Speirs said.

Dej Knuckey is a contributor to Solar Builder. She is a journalist, author and freelance writer who has covered energy for publications in Australia and the U.S.

— Solar Builder magazine

Leave a Reply

You must be logged in to post a comment.