The U.S. Department of Commerce issued its long-awaited final decision in the Auxin Solar tariff case with a finding of circumvention. The final decision largely resembles the preliminary decision, with a determination that: “certain Chinese producers are shipping their solar products through Cambodia, Malaysia, Thailand, and/or Vietnam for minor processing in an attempt to avoid paying antidumping and countervailing duties (AD/CVD).”

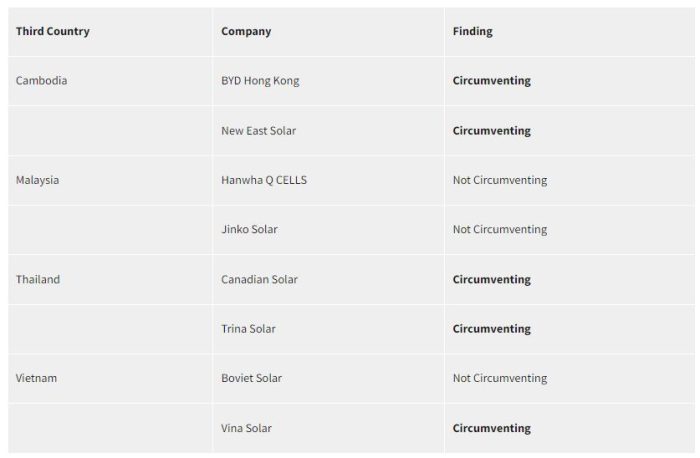

Of the eight companies that responded to Commerce’s request for information across the four countries, five were levied a determination of circumvention:

The only thing that changed from the prelim is New East Solar’s finding of circumvention after it opted not to participate in verification.

Importing solar panels from the manufacturers with a finding circumvention will carry an additional duty. The five companies listed above will each have their own duty determined by Commerce.

Due to Biden’s two-year moratorium, these duties will not be collected on any solar module and cell imports from these four countries until June 2024, as long as the imports are consumed in the U.S. market within six months of the termination of the President’s Proclamation.

Any solar panel manufacturer not listed above (approximately 22 companies) that does not have a company-wide rate, will be assessed the full “country-wide” tariff. The China-wide anti-dumping duty is currently set at 240 percent, and the “all-others” countervailing duty rate is 15.24%.

Going forward, any company in Cambodia, Malaysia, Thailand and Vietnam that did not respond to Commerce’s request for information in this investigation, are found to be circumventing, but will be permitted to certify that they are not circumventing.

Clarifications and reminders

- The determination is focused largely on solar wafers coming from China, which means Commerce has now established, at least in part, that solar cell manufacturing is “minor” processing – which, we’ve reported before, runs counter to previous memos on this topic.

- But the decision is not totally focused on wafer origin. Commerce determined a company to be circumventing if it used Chinese wafers AND sourced more than two of the following materials from China: silver paste, aluminum frames, glass, backsheets, ethylene vinyl acetate sheets, and junction boxes.

- Solar cells made in one of the four Southeast Asian countries, even if made from wafers from China, that are then exported to a non-inquiry country and further assembled into modules or other products there, before exportation to the United States, are not subject to Commerce’s final circumvention findings.

— Solar Builder magazine

[source: https://solarbuildermag.com/news/solar-tariff-circumvention-final-decision-explained/]

Leave a Reply

You must be logged in to post a comment.