Clean energy can fuel economic recovery. Large commercial and industrial (C&I) energy buyers, like corporations with ambitious clean energy goals, are demanding the ability to purchase renewable energy to power their operations and facilities with limited success due to persistent market and regulatory barriers.

Voluntary corporate purchases of renewable energy are already driving significant change in the market, including 26 gigawatts (GW) of renewable energy deployed over the last 10 years (enough to power nearly 6 million homes per year). Corporate buyers signed one-fifth of all power purchase agreements (PPAs) in 2018, and the trend has continued upward with a record 9 GW of corporate transactions last year.ne of renewable energy market growth, but these deals are complex, time-consuming and costly to scale. Large energy buyers in the C&I sector, easily the largest customer segment in the energy market, have pioneered PPAs because they have the resources and dedicated staff to effectively go out and transact the deal.

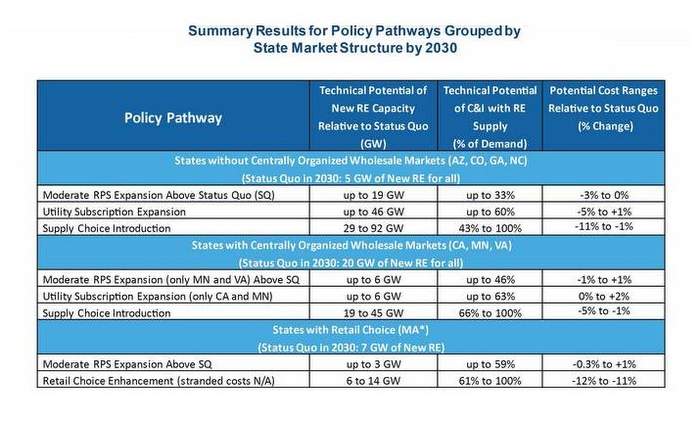

What policies are going to be the fastest, most affordable and most customer-driven to accelerate the transformation of the electricity sector over the next 10 years? The Renewable Energy Policy Pathways Report, recently released from the REBA Institute, analyzes three policy pathways and their tradeoffs:

Supply choice

Supply choice for C&I customers already exists in some places and has the highest technical potential for deployment and cost savings in the long term — but, politically, it is more challenging to expand in the short term. There is a spectrum of what supply choice can mean, from direct access for just C&I customers to full retail restructuring that gives electricity supply choice to all customers. There are smaller bites at the apple, for instance just increasing a direct access program for C&I customers that want to choose their supplier.

RPS raises the floor

While supply choice has the highest technical potential for the most customers to access renewable energy directly, Renewable Portfolio Standards (RPS), assuming moderate increases in state RPS to 2030, have high potential because they increase the amount of renewable energy supplied to all customers. However, customers cannot choose 100 percent renewable energy, which is what many C&I customers need to meet their own public renewable energy goals.

Utility subscription programs

If customers don’t have supply choice, renewable energy subscription programs offered by utilities provide another pathway for customers to opt into higher amounts of renewable energy. These programs already exist with a number of utilities, but they tend to be limited to new load and are not typically cost-competitive.

The bottom line from these findings is that supply choice offers the largest technical potential for the fastest and most cost-effective pathway to increasing customer options, but the expansion of utility subscription programs and RPS are in many ways equally important pathways to pursue.

Putting it all together

The REBA Institute report assumed that if these programs can be extended to all customer types by allowing clean generation to replace naturally retiring fossil plants over the next 10 years, they can provide fairly high potential renewable energy deployment at low cost. Aligning these programs to natural retirements can prevent any potential cost shifts to non-participating customers by not causing stranded costs. This approach also takes advantage of existing utilities’ natural ability to procure power, aggregate customers and manage risk, potentially lowering transaction costs for customers.

A way to drive lower costs across all of these pathways is to create a foundational structure: competitive wholesale power markets or centrally organized wholesale markets. This report finds that organized markets save customers billions of dollars and help integrate more renewable energy by operating power markets that efficiently and more effectively value renewable energy.

In many ways, the pathways end up working in tandem: Additional utility or supply options on top of an RPS allow companies to meet their more ambitious goals while potentially driving the transition in the electric sector faster than state or utility goals alone. Empowering customers to lead this transition through their purchasing power can accelerate progress and drive down costs to the benefit of all energy customers. None of this is simple, or easy. If we want our economy to not just fully recover but rebuild better and stronger than before, following the pathways outlined in this report will help get us there.

Bryn Baker, director of policy innovation for the Renewable Energy Buyers Alliance.

— Solar Builder magazine

Leave a Reply

You must be logged in to post a comment.