The rumors were true: A new petition has been filed to the U.S. International Trade Commission (USITC) and the U.S. Department of Commerce (DOC), to apply new tariffs (both anti-dumping and countervailing duties) to imported solar cells and modules from Southeast Asia.

As expected, the reaction from the U.S. solar industry depends on the source. The Solar Energy Industries Association (SEIA), American Clean Power Association (ACP), Advanced Energy United (United), and American Council on Renewable Energy (ACORE) united to express displeasure because of how tariffs will impact pricing and the general momentum of the marketplace:

“We are deeply concerned the AD/CVD petitions will lead to further market volatility across the U.S. solar and storage industry and create uncertainty at a time when we need effective solutions that support U.S. solar manufacturers. We need constructive actions, like the Advanced Manufacturing Tax Credit and other policies, to expand domestic solar manufacturing and deploy clean energy at scale and speed to serve growing electricity demand.”

Many solar module manufacturers and suppliers with U.S.-based operations are for the petition — and actually submitted the petition. The American Alliance for Solar Manufacturing Trade Committee, which consists of Convalt Energy, First Solar, Meyer Burger, Mission Solar, Qcells, REC Silicon, and Swift Solar, made this statement:

“This doesn’t come as a surprise. Everyone knows these Chinese-headquartered companies in Southeast Asia are benefiting from subsidies and exporting below-cost solar into the U.S. market, harming American solar manufacturers and their workers. Conditions are untenable for American solar manufacturers. SEMA will continue to fight for strong trade enforcement and onshoring our supply chain so American companies can thrive and we can usher in a new era of clean energy independence.”

From a timing perspective, we expect the Department of Commerce to initiate on the cases in about a month. Here’s the Who, What, Where, When and How Much as we know it today:

Where

Targeted Countries: Petitions – both AD and CVD for all countries – were filed on April 24, 2024, against Cambodia, Malaysia, Thailand, and Vietnam. India was not named (many speculated it would be).

Country of Origin of Cell Dictates Country of Origin of Module: Per previous decisions by Commerce and CBP, the country of origin of a solar module is dictated by the country of origin of the cells contained within it. Petitioner states there may be solar modules entering the U.S. from third countries (e.g., India) that contain subject country-origin cells (i.e., cells produced in one of the 4 named countries). These solar modules would be subject to the new AD/CVD investigations. However, modules, laminates, and panels produced in a 4-SEAC country from cells produced in a third-country would not be covered by the new investigations.

Who

Petitioners: The Petitions were filed on behalf of the American Alliance for Solar Manufacturing Trade Committee (“AASMTC” or “Petitioner”). Members of the AASMTC are Convalt Energy; First Solar, Inc.; Hanwha Q CELLS USA, Inc.; and Mission Solar Energy LLC). The following companies are listed as supporters of the Petitions: Meyer Burger (Americas) Ltd., REC Silicon, and Swift Solar.

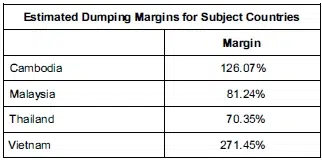

The petition lays out antidumping margins for each of the subject countries and calculates an AD margin. Jinko was used as an example for Malaysia, Boviet for Vietnam, Talesun for Thailand, and Hounen Solar for the Cambodia calculations. Other Tier 1s were also cited in the petitions, including LONGi, Trina, and JA Solar.

What

Antidumping (AD) and Countervailing Duty (CVD) Measures: AD/CVD measures (typically tariffs) are used to remedy the economic advantage created by unfair foreign pricing and government subsidies. The U.S. Department of Commerce is responsible for investigating dumping and subsidization. The U.S. International Trade Commission is responsible for investigating whether the domestic industry producing the “like product” (in this case, cells, modules, laminates, and panels) is experiencing “material injury” (economic harm) by reason of the dumped and subsidized imports.

Injury Allegations: The petitioners allege that SE Asian exporters are selling at prices below normal value and request that antidumping duties be imposed in an amount sufficient to offset the unfair pricing described in the reports.

In determining whether a domestic industry is experiencing material injury caused by dumped and/or subsidized imports, the Commission considers: (1) the volume of imports of the subject merchandise; (2) the effect of imports of that merchandise on prices in the United States for domestic like products; and (3) the impact of imports of such merchandise on domestic producers of domestic like products. Petitioners have provided information and argument related to each of the injury factors.

Scope: The merchandise covered by these investigations is “crystalline silicon photovoltaic cells, and modules, laminates, and panels, consisting of crystalline silicon photovoltaic cells, whether or not partially or fully assembled into other products, including, but not limited to, modules, laminates, panels and building integrated materials.”

Like Product: Petitioner states the Commission should “define a single like product coextensive with the scope in this investigation, including both cells and modules”. Whether cells and modules are a single like product, or two separate like products, could be an issue of contention in the injury analysis.

How much

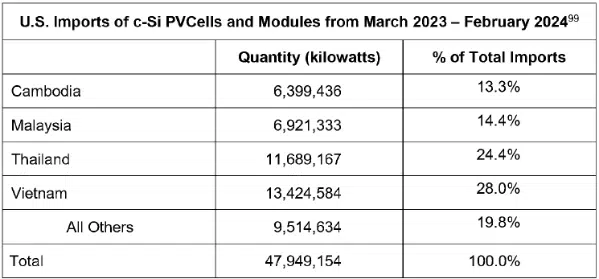

Estimated Dumping Margins: According to the petition, ~80% of the volume of C-Si cell and module imports to the US from March 2023 through February 2024 came from the four main Southeast Asia countries, with the most from Vietnam. The petitioners estimate that U.S. imports of C-Si cells and modules from March 2023 through February 2024 from highest to lowest in terms of MW have been from Vietnam (28%), followed by Thailand (24%), Malaysia (14%), and Cambodia (13%), with all other countries representing ~20%.

Commerce may determine to assign a dumping margin provided in the petition to an individual company under certain circumstances, including where a mandatory respondent company refuses to participate in the investigation. On a separate note, Commerce considers Vietnam a non-market economy (NME) which can result in Commerce applying a methodology for calculating dumping margins different from the methodology used to calculate dumping margins in cases involving market economies (which likely is why the estimated duty for Vietnam is significantly higher than for other countries).

Estimated Countervailing Duty Rates: Petitioners did not provide estimated countervailing duty rates because they are not required to do.

When

Timing of Tariffs: With a filing date of April 24, preliminary determinations in the AD investigations could be issued around Oct. 1, 2024. Importers would then be required to pay cash deposits (estimated duties) on entries of cells and modules from the subject countries. Preliminary determinations in CVD investigations could be issued around July 18, and would also trigger payment of cash deposits. Note the date for preliminary determinations (and final determinations) can be extended.

Estimated Timeline, with additional dates in case retroactive duties are put in place. Source: SEIA

- Apr 24, 2024: Petitions filed

- May 14, 2024: Commerce/ITC initiates investigations

- June 8, 2024: ITC makes preliminary injury determination

- July 18, 2024: Commerce issues CVD preliminary determinations (unless date extended)

- [≈Apr 25, 2024 Duties collected retroactive 90 days from date of publication of CVD prelim if Commerce finds critical circumstances]

- Oct. 1, 2024: Commerce issues AD preliminary determinations (unless date extended)

- [Commerce issues CVD final determinations (unlikely; expect Commerce to align AD and CVD final determinations)]

- [≈July 8, 2024 Duties collected retroactive 90 days from date of publication of AD prelim if Commerce finds critical circumstances]

- Dec. 15, 2024: Commerce issues AD and CVD final determinations

- Jan. 29, 2025: ITC makes final injury determination

- Feb. 5, 2025: AD/CVD Orders issued

What else

Relationship Between Auxin Circumvention Tariffs and New Solar AD/CVD Investigation Tariffs: The scope of the new AD/CVD investigations specifically excludes products covered by the scope of the China AD/CVD Orders. This language provides the basis for Commerce to distinguish imports subject to the new AD/CVD investigations from imports subject to the Auxin circumvention proceeding, so as to not double tariff an entry.

For example, entries of Thai modules that are circumventing (and thus subject to the tariff assigned to exporter as a result of the Auxin circ proceeding) will not be subject to new AD/CVD tariffs that result from the new investigations. Distinguishing imports subject to the new AD/CVD investigations from circumventing imports could be complicated.

Critical Circumstances: Petitioners did not allege critical circumstances in the petitions, but they could do once the cases are initiated. If “critical circumstances” exist, Commerce will order the retroactive collection of duty deposits for entries made during the 90-day period before the publication date of the preliminary determination. The general purpose of the critical circumstances statutory provisions is to prevent companies from rapidly increasing imports to “beat the clock” prior to the date Commerce would normally require cash deposits.

For any additional questions on this whole process in general, see some of these features from our archives:

— Solar Builder magazine

Leave a Reply

You must be logged in to post a comment.